Introduction

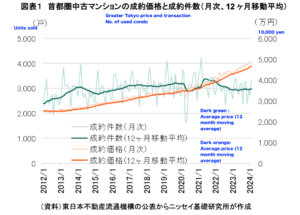

*Greater Tokyo transaction price and transaction numbers

(From NLI chart)

As a leading expert with 15 years of experience as a residential property investor and landlord in Tokyo’s real estate market,

Yamamoto Property Advisory offers unparalleled insights and tailored investment strategies

for foreign investors looking to navigate this dynamic landscape.

Our deep understanding from a landlord’s perspective enriches our advisory services,

ensuring that you receive the most informed and strategic guidance available.

The report from NLI Research Institute, a think tank of Nihon Life insurance group, dated March 22, 2024,

provides an analysis of the used condominium market in the Tokyo metropolitan area (greater Tokyo, including

Tokyo, Kanagawa, Saitama and Chiba)with a focus on the effects of financial policy changes

and market dynamics.

The used condominium market in the Tokyo metropolitan area has a significant impact on the overall real estate market in Japan

due to its large scale and influence,and because Tokyo is the center of economic activity in Japan. For this reason,

this market is considered an indicator of the entire Japanese real estate market.

Here’s a concise summary of the main points of the report.