1. Introduction

This article delves into a critical case study that surfaced in the real estate sector, highlighting not only the complexities inherent in property transactions

but also underscoring the indispensable role of diligent research and ethical practices in this field.

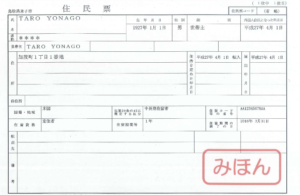

At the heart of our discussion is a real estate transaction that unraveled into a legal and ethical quagmire, involving a buyer, a broker, and a seller.

This case, which led to the administrative sanction of a broker for failing to return a deposit after a deal’s cancellation,

serves as a quintessential example of the pitfalls that can occur in real estate dealings.

The importance of this case extends beyond the specifics of its narrative.

It sheds light on a wider issue in the real estate industry: the necessity for transparency, legal compliance, and ethical conduct.

For potential buyers, sellers, and even real estate professionals, this case underscores the crucial need for thorough research and due diligence.

In an industry where transactions involve significant financial and emotional investments,

the consequences of neglecting proper checks and balances can be dire.

Our exploration of this case begins by setting the scene — outlining the key events as they unfolded,

and the roles and responsibilities of the involved parties.