For Foreigners: The Importance of Japanese Contracts and How to Explain Them?

Pros and Cons of Conducting Real Estate Transactions for Foreign Clients Using Contracts Translated

into Foreign Languages

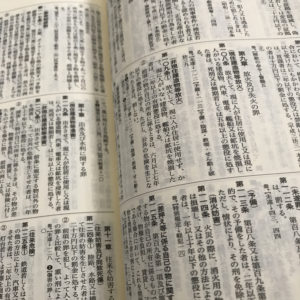

We found a very interesting article on the Real Estate Transaction Promotion Center’s (公益財団法人 不動産流通推進センター)website.

In this article, we will share the content and inform you of our company’s approach to this issue.

Background and Key Figures

The background of the article is based on a consultation with a real estate company (Not Yamamoto Property Advisory)

that is not experienced in handling foreign clients.

As real estate transactions with foreign clients increase, said brokerage firm, specializing in sales and rentals, faces the challenge of preparing transaction documents

in foreign languages and arranging interpreters.