Are you an investor exploring alternative

real estate investment opportunities in Asia?

The recent changes in Singapore’s property tax regulations may prompt you to look elsewhere

for promising investments.

As a Japanese real estate agent specializing in assisting foreign investors,

I’m here to help you navigate this changing landscape and

discover the potential of Japan’s real estate market.

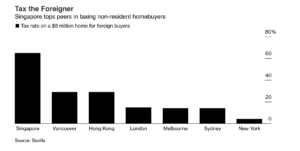

Singapore recently unveiled new measures aimed at wealthy Chinese investors to tackle concerns

over escalating property prices and wealth inequality.

By doubling property taxes for foreign buyers, the government is working to strike a balance

between drawing foreign investments and safeguarding its citizens’ interests.

Foreign investors now face a 60% tax on residential property purchases,

with higher taxes also imposed on permanent residents and citizens purchasing their second property.

These measures come in response to the surge of ultra-affluent Chinese individuals

entering Singapore due to stringent pandemic restrictions.

Consequently, family office assets at Singapore’s banks have swelled,

causing luxury items’ costs to skyrocket and raising worries about a growing wealth gap.

The new tax rules precede the general election due by 2025,

with housing being a significant issue in Singapore.

Despite the tax hike for non-resident homebuyers,

Singapore’s home prices persist in defying the global slowdown.

Bloomberg Intelligence forecasts a 5% rise in 2023 after a 3.2% gain in the first quarter.

However, experts believe the new regulations will not dramatically impact the mass market,

as foreigners only represented 4.4% of private home sales in 2022.

The policy adjustments will affect about 10% of residential property transactions.

The rental market is likely to see heightened demand as foreign buyers rent

while awaiting permanent residency or citizenship.

Singaporeans may also opt to rent between selling their first property and acquiring another.

National Development Minister Desmond Lee stated that the new rules serve

as an early measure to dampen investment demand and prevent

the 10% figure from rising significantly.

Properties in the S$6 million ($4.5 million)

and higher categories will probably be more affected by the new measures,

as Singapore’s property prices have continued to increase.

Chinese buyers have constituted the largest foreign buyer group since 2016,

accounting for 6.9% of foreign purchases of private apartments last year.

With China’s borders reopening,

more buying interest from mainland Chinese individuals is anticipated.

The new measures are deemed more “preemptive” than immediate,

intending to slow down purchases from foreign buyers before they cause further

imbalance in the property market.

Singapore aims to balance attracting foreign investments while maintaining housing affordability

for its citizens.

As the global economy continues to evolve,

Singapore must adapt its policies to maintain this delicate balance and protect its citizens’ interests.

Source:https://www.bloomberg.co.jp/news/articles/2023-04-28/RTT2YZDWRGG001

*

Japan impose zero extra tax for foreigners in real estate transactions.

(Insight)

Unlike other Asian countries, foreigners can buy any property anywhere in Japan.

(Exception is the areas surrounding the military base)

You don’t even require a visa to buy a property here.

Your legal right such as ownership of your property, is rigorously protected by Japanese laws.

You may not see the sharp rise (and down) in price like the United States; however, if you want to enjoy

steady return on investment, Japan is an ideal destination for you.

Are you a foreign investor seeking new real estate opportunities

in the wake of Singapore’s policy changes?

Japan’s real estate market offers immense potential for foreign investors.

Contact us today to learn how we can help you navigate Japan’s property market and

identify lucrative investment opportunities tailored to your needs.

Together, we can unlock the full potential of Japan’s thriving real estate market.

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and Sell Real Estate in Japan” is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link