Discovering Lucrative Opportunities in Japanese Real Estate

for High-Net-Worth Investors

Introduction:

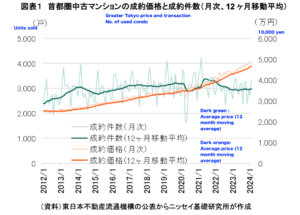

Japan has long been an attractive destination for high-net-worth individuals

who appreciate its rich culture, modern cities, and stunning landscapes.

As the yen continues to depreciate and real estate prices remain relatively low compared to other global cities,

now is the perfect time for investors with a net worth of 1-2 million

US dollars to explore opportunities in the Japanese property market.

Prime Locations:

While Tokyo is the most popular choice for foreign investors,

other metropolitan areas such as Osaka and Nagoya also offer attractive investment prospects.

For those interested in resort properties, Hokkaido and Okinawa are becoming increasingly popular choices.

Example Properties in Tokyo:

Minato-ku, Tokyo: A luxurious 2-bedroom apartment in the upscale Minato-ku district offers

investors a taste of cosmopolitan living. With a price tag of around $1 million,

the apartment offers a potential rental yield of 4-5%.

Shibuya-ku, Tokyo: A modern one-bedroom apartment in the vibrant Shibuya-ku area offers

a more affordable investment option at around $500,000.

The potential rental yield for this property is approximately 3-4%.

Read more