Land Value Surge in 2024: Insights for Foreign Investors in Tokyo and the Kanto Region

Key Points:

- Metropolitan Area Focus

- Economic Trends

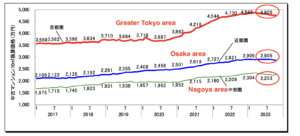

On July 1(2024), the National Tax Agency announced the land value(路線価)

as of January 1, showing a national average increase of 2.3%,

marking the third consecutive year of growth.

This rise, the largest in 16 years, is driven by the recovery of inbound tourism,

redevelopment projects, and increased housing demand.

Regional Highlights:

The average land value increased in 29 prefectures, with the highest increases in:

- Fukuoka: +5.8%

- Okinawa: +5.6%

- Tokyo: +5.3%

- Hokkaido: +5.2%

- Miyagi: +5.1%

- Aichi: +3.2%

- Osaka: +3.1%

- Saitama: +2.1%