Introduction:

Tokyo, a city that seamlessly blends the ultramodern with the traditional, stands as a beacon of opportunity in the global real estate landscape. For foreign investors looking to dive into this market, understanding its current trends is crucial. In this comprehensive guide, we’ll explore the latest developments in Tokyo’s real estate market, focusing on the used condominium sector, which offers insightful glimpses into the city’s economic heartbeat.

*Please click to enlarge the image

*Please click to enlarge the image

The Pulse of Tokyo’s Real Estate Market:

As of late 2023, Tokyo’s real estate market has been exhibiting intriguing trends that are shaping investment opportunities. The market, known for its resilience and dynamism, has been responding to various economic, demographic, and global influences.

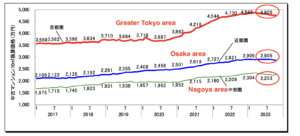

1. The Subtle Shift in Prices: The average price for a 70㎡ used condominium in the Tokyo metropolitan area has seen a slight decrease, now standing at around 47.6 million yen. This change, though modest, is significant in a market renowned for its stability and steady growth. It reflects a nuanced response to broader economic trends, including Japan’s demographic shifts and the global economic climate.

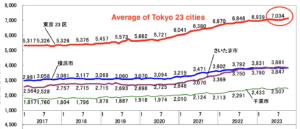

2. The Diversity within the 23 Wards: Tokyo’s 23 wards, each with its distinct character, present a mosaic of micro-markets. Notably, there’s been a 0.5% increase in prices in these areas, with an average price reaching 71.32 million yen. This increase is particularly pronounced in wards like Minato, Shibuya, and Chiyoda, which are synonymous with luxury and exclusivity. These areas continue to attract high levels of investment due to their central location, proximity to business districts, and vibrant cultural scenes.

The average price in Tokyo 23 cities area saw a growth of 28% over the past five years.

Conversely, wards like Taito and Sumida offer more affordable options while still providing access to Tokyo’s core. These areas are gaining popularity among young professionals and families, creating a burgeoning demand for residential properties.

3. Spotlight on Central Tokyo: Central Tokyo, especially the six wards of Chiyoda, Chuo, Minato, Shinjuku, Bunkyo, and Shibuya, is witnessing a significant price increase. In October 2023, these areas saw a 1.8% rise in prices, with a 70㎡ unit averaging 107.91 million yen. This trend underscores Central Tokyo’s enduring appeal as a prime real estate location.

The average property price in the central six wards of Tokyo has experienced a remarkable growth of

approximately 40% over the past five years.”

The reasons behind this robust growth are manifold. Central Tokyo is not just Japan’s economic heart but also a cultural and lifestyle epicenter. The area is home to iconic landmarks, luxury shopping districts, and a plethora of dining and entertainment options. The blend of ultra-modern living and rich cultural heritage makes Central Tokyo an attractive destination for both domestic and international buyers.

*Please click to enlarge the image

4. The Appeal of Tokyo’s Real Estate Market: Tokyo’s real estate market is appealing for several reasons:

- Stability and Growth: Tokyo’s market is known for its stability, making it a safe haven for investors, especially in times of global economic uncertainty.

- High Demand and Low Supply: In central areas, the limited availability of new properties creates a market driven by high demand and low supply, leading to potential price appreciation.

- Diverse Investment Opportunities: From luxury properties in central wards to more affordable options in the outskirts, Tokyo offers a range of investment opportunities to suit different budgets and investment strategies.

5. Navigating the Market as a Foreign Investor: Investing in Tokyo’s real estate market as a foreigner comes with its unique set of challenges and opportunities. Understanding the market dynamics, legal frameworks, and financial considerations is key. Here are some tips:

- Research and Due Diligence: Thorough market research and due diligence are essential. Understanding the local market trends, property laws, and tax implications is crucial.

- Seek Local Expertise: Partnering with a local real estate agent who understands the nuances of the Tokyo market can be invaluable.

- Consider Long-Term Trends: Look beyond current market fluctuations and consider long-term trends and potential growth areas.

Conclusion: Tokyo’s real estate market continues to offer exciting opportunities for foreign investors. With its blend of stability, diversity, and growth potential, the market in Tokyo is ripe for investment. Whether you’re looking for a high-end property in the city’s central wards or a more affordable option in the surrounding areas, understanding the current trends is key to making a successful investment.

As you embark on your investment journey in Tokyo, remember that knowledge, due diligence, and the right partnerships are your keys to unlocking the potential of this vibrant real estate market.

Insight:

Let’s turn Japan’s real estate potential into your investment reality.

Contact us now!

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and Sell Real Estate in Japan” is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link

Source: Tokyo Kantei report