A Riverside Machiya (町家、Traditional Kyoto Townhouse) – A 400-Year Legacy, A Modern Investment

1. Introduction – Kyoto as a Global Destination

Kyoto is not only Japan’s ancient capital but also one of the world’s most celebrated cities.

It has repeatedly ranked at the very top of international travel surveys. In 2020, Condé Nast Traveler readers named it the Best Big City in the World, surpassing Tokyo. In 2024, National Geographic included Kyoto in its “Top 20 Travel Experiences,” while Architectural Digest placed it among the “Most Beautiful Cities in the World.”

For international investors, Kyoto is more than a cultural icon—it is a global real estate brand in its own right.

2. Market Data – Inbound Tourism Surge

Kyoto’s popularity is backed by impressive data:

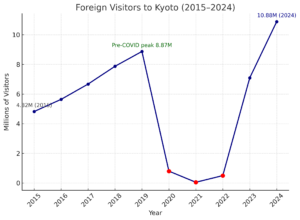

- In 2015, the city welcomed 4.82 million foreign visitors.

- By 2024, that number had surged to 10.88 million, an all-time high—more than double within a decade.

- For the first time on record, foreign overnight guests (8.21 million) exceeded domestic guests (8.09 million).

- Hotels reported 78.5% occupancy, an ADR of ¥20,195, and a 61% foreign guest ratio.

Nationally, Japan hosted 36.87 million foreign visitors in 2024, up from 25 million in 2023 (+47% YoY) and only 0.5 million in 2022. Kyoto sits firmly at the very center of this dramatic rebound.

3. Location Advantage – The Kamo River Premium

Among Kyoto’s many districts, the Kamo River frontage represents the pinnacle of desirability.

In summer, riverside terraces of restaurants are filled with tourists enjoying the evening breeze. Owning a private terrace overlooking the Kamo River transforms this fleeting experience into an everyday luxury.

This property sits just south of Gojo Bridge, within walking distance of Gion and Sanjo. Its second-floor terrace offers uninterrupted views of the river and surrounding mountains—a vantage point few properties in Kyoto can offer.

https://maps.app.goo.gl/ctFfYn5hvnWojPre7

4. Property Highlights – Tradition Meets Luxury

Property Snapshot (Case Example)

- Location: Just south of Gojo Bridge, overlooking the Kamo River

- Land Area: approx. 116 sqm

- Building Area: approx. 167 sqm (2 floors)

- Layout: 6 rooms plus kitchen (6K) + traditional tsuboniwa garden (6K+garden)

- Price: JPY 348,000,000 (~USD 2.3M)

- Condition: Fully renovated while preserving traditional machiya aesthetics

- Features: Private tatami tea-room, modern kitchen & bathrooms, rare second-floor river-view terrace

Usage Note:

This property is currently operated as a licensed ryokan (traditional inn). As such, it cannot be used exclusively as a private residence. However, because it is a standalone house, owners may exercise flexibility by blocking reservations—for example, reserving a two-week period for personal use. This dual character provides both a stable hospitality business and limited opportunities for private enjoyment.

This property exemplifies Kyoto’s unique blend of heritage and modernity. The tatami tea-room evokes centuries of cultural tradition, while modern renovations—luxury bathrooms, designer kitchen, and spacious interiors—ensure comfort at a global standard. The river-view terrace elevates the lifestyle value far beyond what any hotel suite can offer.

layout

5. Market Context – Price Trends & Supply Constraints

While Tokyo’s luxury market dominates headlines with condominiums exceeding ¥100 million on average, Kyoto offers a very different proposition:

- Heritage restrictions strictly limit supply.

- New construction rarely competes with the cultural cachet of historic machiya.

- Post-pandemic, prices of high-end Kyoto assets have continued to climb, driven by scarcity and strong global demand.

Kyoto’s premium properties are not about volume—they are about the scarcity premium.

6. Overtourism Challenges – Kyoto’s Double-Edged Sword

Kyoto’s global success brings challenges. Like Venice or Barcelona, it faces overtourism: congested transport, rising rents, and tensions in districts such as Gion.

The municipal government has responded with measures such as accommodation taxes, tourism dispersal strategies, and even photography restrictions in certain areas.

For investors, this creates two key implications:

- Demand durability – tourism demand remains undeniable.

- Regulation risk – only fully licensed, high-quality hospitality or residential assets are sustainable.

Thus, premium properties with proper permits are the safest path to align with both regulations and community expectations.

7. Investment Perspectives – Opportunity and Risk

- Short term: Operate as a luxury hospitality asset (licensed ryokan or boutique inn).

- Medium term: Use selectively for personal stays by blocking reservations.

- Long term: Hold as a heritage asset with enduring scarcity value.

Risks include higher maintenance costs for traditional architecture, regulatory compliance, and lower liquidity compared with Tokyo condos. Yet for investors seeking diversification, prestige, and cultural resonance, the value proposition is compelling.

8. Global Comparisons – Kyoto vs Other Heritage Cities

Kyoto’s machiya can be compared with heritage assets in Florence, Venice, and Paris.

All share limited supply, cultural prestige, and high tourism demand. However, Kyoto offers an additional edge: a living, evolving cultural heritage within a safe and politically stable environment.

9. Cultural Heritage – The 400-Year History of Kawayuka

The property’s Kamo River terrace is part of a 400-year-old cultural tradition.

Riverside dining, known as kawayuka or noryo-yuka, began in the early Edo period. Tea houses and restaurants built temporary platforms along the river to attract visitors during the hot summer months, offering a breeze-cooled retreat known as “Kawahara no Suzumi.”

By the Taisho era, the custom had evolved into a signature Kyoto experience. Guests enjoyed tea and meals literally above the flowing water, a practice that became a seasonal highlight. Today, around 100 establishments set up terraces each summer from May to September.

For a property owner, this tradition becomes a private, daily privilege rather than a fleeting restaurant experience.

10. Experiencing Kawayuka (川床)– Three Areas of Kyoto’s Riverside Culture

Kyoto offers three distinct kawayuka areas, each with its own flavor of riverside dining:

-

Kamo River (鴨川): Iconic and central, stretching from Nijo to Gojo, historically the heart of kawayuka culture.

-

Kibune (貴船): Nestled in the mountains, with terraces directly above streams and surrounded by greenery.

-

Takao (高雄・衣笠): Known for its autumn foliage as well as summer coolness, combining natural beauty with historic temples.

While visitors may enjoy them seasonally, owning a private riverside terrace in central Kyoto transforms this cultural heritage into an exclusive year-round lifestyle.

11. Diversity and Accessibility – Beyond Traditional Cuisine

When people think of kawayuka, they often imagine classic Kyoto kaiseki cuisine. But the reality is far broader. Along the Kamo River, diners can choose from a wide range of options—French, Italian, Chinese, izakaya-style casual dining, even modern cafés.

This diversity makes kawayuka accessible to first-time visitors and connoisseurs alike. And because the terraces are located in the very heart of the city, access is effortless—making them one of Kyoto’s most approachable yet refined cultural experiences.

12. Conclusion – Owning Kyoto’s Heritage

Owning a Kyoto property overlooking the Kamo River is not simply a real estate transaction—it is the acquisition of cultural legacy.

It provides:

-

Tangible returns through hospitality income

-

Potential appreciation from scarcity

-

Intangible prestige as a custodian of heritage

But beyond numbers, it offers something rarer: the privilege of living within a 400-year-old cultural tradition, in the very heart of Japan’s most celebrated city.

👉 Properties like this are exceptionally rare and highly sought-after. They do not stay on the market for long. If you are seriously considering Kyoto as part of your global portfolio, now is the time to act. Contact Yamamoto Property Advisory today to secure this opportunity before it disappears or email yamamoto@yamamoto-property.jp

#KyotoRealEstate #LuxuryProperty #Machiya #KamoRiver #JapanInvestment #CulturalHeritage #RyokanInvestment #KyotoLuxury #InboundTourism #HeritageHomes

About Toshihiko Yamamoto

Toshihiko Yamamoto is the founder and principal broker of Yamamoto Property Advisory, specializing in luxury and investment properties for an international clientele. With over two decades of global business experience and a CCIM designation, he provides trusted guidance to foreign investors navigating Japan’s real estate market.

📘 Author of “The Savvy Foreign Investor’s Guide to Japanese Properties” – available on Amazon, iBooks, and Google Play.

👉 Connect with us for exclusive listings and investment insights:

-

LINE – Direct inquiries in Japan

-

WhatsApp – International client contact

-

Instagram – Market snapshots & updates

-

YouTube – In-depth video analysis

Scan below to connect instantly.

About the book

Amazon.com Link