FROM DREAM TO LUXURY TOKYO HOMES NOW START AT ¥20M+/YEAR INCOME

Based on Tokyo Kantei’s July 2025 report on income requirements for new condo purchases

Introduction: The Era of Extreme Affordability Gaps

The Tokyo condominium market is undergoing a dramatic transformation. While Japan’s national wages remain relatively flat, the cost of buying a new 70m² condominium in Greater Tokyo is rising at an unprecedented rate. According to Tokyo Kantei’s July 2025 report, the number of train stations where buyers must earn over ¥10 million per year has surged. In fact, income thresholds for central locations now reflect a level of exclusivity once reserved only for the super-rich.

This is not just about real estate prices. It is about what kind of city Tokyo is becoming.

From Middle-Class Dream to Millionaire Prerequisite

¥10M+ Households: A New Normal?

In 2024, 38.3% of all train stations in Greater Tokyo require an annual household income exceeding ¥10 million to afford a newly built 70m² condo. In 2019, that share was only 25.4%. This income level, which already represents the top ~15% of Japanese households, is now the baseline in over one-third of locations.

Power Couples Rewriting the Urban Map

The number of stations requiring ¥15M+ household income has risen from 15 (4.2%) in 2019 to 40 stations (14.2%) in 2024. These are generally dual-income professionals: lawyers, executives, doctors, entrepreneurs. While they once concentrated in Minato, Shibuya, and Chiyoda wards, they are now stretching into northern Yamanote areas, Setagaya, and even parts of Saitama and Kanagawa.

Power Families: The ¥20M+ Frontier

Perhaps the most symbolic shift is in the highest bracket. In 2019, only 5 stations required more than ¥20 million in annual income to purchase. In 2024, that number has ballooned to 21 stations (7.4%). Developers are increasingly targeting these so-called “Power Families” — high-earning households with children, often international in outlook. Tokyo is becoming a high-barrier city.

Where the Richest Can Buy: Top 10 Most Expensive Stations

| Rank | Station (Line) | Estimated Income Required (JPY million) |

|---|---|---|

| 1 | Shirokane-Takanawa (Toei Mita Line) | ¥42.33M |

| 2 | Omotesando (Tokyo Metro Ginza Line) | ¥41.77M |

| 3 | Azabu-Juban (Tokyo Metro Namboku Line) | ¥38.57M |

| 4 | Kamiyacho (Tokyo Metro Hibiya Line) | ¥32.12M |

| 5 | Shibuya (JR Yamanote Line) | ¥30.47M |

| 6 | Motomachi-Chukagai (Minatomirai Line) | ¥27.91M |

| 7 | Yotsuya (JR Chuo Line) | ¥27.00M |

| 8 | Shinjuku-Gyoenmae (Tokyo Metro Marunouchi) | ¥26.78M |

| 9 | Ginza (Tokyo Metro Ginza Line) | ¥26.31M |

| 10 | Daimon (Toei Asakusa Line) | ¥25.74M |

These income levels imply a minimum monthly gross income of ¥2.5M to ¥3.5M just to qualify for a mortgage — before taxes, living costs, or education expenses.

What’s Driving This Polarization?

1. Developer Strategy: The Luxe Shift

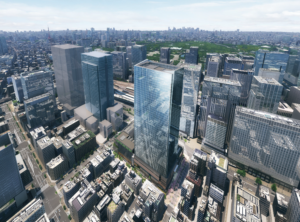

Major developers are consciously targeting high-income demographics. Statements from Mitsui Fudosan and Mori Building show a pivot toward properties for buyers earning over ¥20 million per year. New supply is being concentrated in luxury towers like Park Court, Branz, and branded residences like Aman Tokyo and Bulgari.

2. Lack of Middle-Income Supply

The market is not producing affordable new homes. Average wage earners (earning ¥6–8M) are increasingly shut out. Suburban supply remains limited and often lacks the infrastructure or prestige desired by upwardly mobile families.

3. Foreign Capital & Dual-Use Buyers

High-net-worth buyers from overseas (particularly from Singapore, Hong Kong, and the UAE) are inflating values in key wards. Some condos are held as pied-à-terres or investment assets, not primary homes.

Who Is Being Left Behind?

This affordability gap is increasingly pushing out:

- Young professionals and startup founders who cannot yet reach ¥15M

- Local dual-income families trying to stay in Tokyo 23-ku

- Elderly downsizers looking to remain in central wards

This leads to a hollowing out of the middle class, and increased reliance on rental housing in less desirable locations.

Policy and Planning: What Should Be Done?

- Zoning reforms to allow for more mid-rise, mid-priced housing

- Incentives for developers to build family-oriented, affordable condos

- Monitoring of foreign ownership patterns to ensure local housing access

- Data transparency so that consumers can track price/income shifts across stations

Conclusion: Tokyo at a Crossroads

Tokyo is entering a new phase of urban housing dynamics. The city is fast becoming a capital for the ultra-rich, both domestic and international. While this may attract global capital and brand prestige, it risks losing the diversity and balance that makes Tokyo liveable.

The question remains: Is Tokyo still building homes for its people — or only for its investors?

If you are a global investor, policymaker, developer, or future homeowner concerned with Tokyo’s housing trajectory, now is the time to pay attention.

🏡 Contact us for bilingual market insights, data-backed advisory, or to explore high-end or alternative housing strategies across Japan.

🔗 Contact us or email yamamoto@yamamoto-property.jp

Source: Tokyo kantei report (in Japanese)

Connect with Us for Exclusive Listings & Investment Insights

- LINE – Direct inquiries in Japan

- WhatsApp – For global investors & clients abroad

- Instagram – Market snapshots, listings & updates

- YouTube – In-depth property videos & expert analysis

📱 Scan below to connect instantly.

About the book

Amazon.com Link

#TokyoRealEstate

#HousingInequality

#UrbanPlanning

#LuxuryCondos

#TokyoMarket2025

#ForeignInvestment

#PropertyTrends

#PowerCouples

#JapanHousing

#SustainableUrbanism