(Picture: Yokohama)

Recruit Sumai Co., operator of the Suumo residential information website, recently released the ranking of locations

(and train stations) where people in the Kanto region want to reside in 2018.

(Kanto region in this report covers Tokyo, Kanagawa, Chiba, Saitama and Ibaraki)

They released the same report for Kansai region (including Osaka, Kyoto and Kobe as well.

The survey began in 2010 and has been conducted every year.

7000 people in the Kanto area responded and they are in the

age between 20 and 49. People over 50 years old are not surveyed, which naturally distorts the statistics.

Here is the ranking for 2018 and data in 2017 and 2013 are also illustrated for a comparison purpose.

Investing in Japan

Real estate investment : Is Tokyo’s property bubble finally ready to burst ? (if any)

The RECRUIT company (major Japanese real estate advertisement company) released its own survey on people from greater Tokyo area (Tokyo, Kanagawa, Saitama and Chiba) who have purchased the newly built condominiums in 2017.

Over 4700 people responded.

Here is the quick summary of the report.

1. Location of condo purchased

Tokyo’s 23 wards increased its share slightly from 2016 to 43% and

20% of respondents bought condos in “Kanagawa prefecture”. (ranked 2nd next to Tokyo 23 wards)

2. Price

The average purchase price of condos is 54.52 million yen,

(U$500,000), the highest since the survey started in 2001.

3. Trend in each prefecture

The average price in Tokyo 23 wards exceeded 60 million yen (U$545,000) for the first time since the survey began

4. Age

The average age is 38.6 years old and the households with children account for 45%.

5. Income and household

Average households total annual income is 9.44 million yen(U$89,000), Married couples account for 65%

Households with annual income of 10 million yen or more gradually increase, to 36%. 65% of households generate dual income (both husbands and wives working), the highest since the survey began in 2001.

57% of single-person households buy the condominiums within Tokyo 23 wards which is significantly higher than other households.

(Breaking news) New mortgage loan for the rental investment by a Japanese bank for foreign nationals

Just a quick breakthrough note :

Last week, we have managed to establish the strategic alliance with one of the prominent Japanese banks who can offer foreign nationals loan for the investment property in Japan.

There are three categories.

1. Foreign nationals who reside in Japan with the permanent residence

(Individuals who live in Japan without PR could be also eligible)

2. Foreign individuals who reside in Hong Hong (Hong Konger)

3. Foreign nationals who do not live in Japan

Category 2 and 3 are the breakthrough products.

No Japanese banks have been willing to offer the loan for foreign nationals who do not live in Japan but the window has just opened.

Obviously there are certain conditions such as down payment and taking out the mortgage.

And the approval is subject to the valuation of the property by the bank and financial status of each investor.

In addition, you need to carefully select a property which the bank is likely to offer the loan by meeting their criteria.

My bank is very picky about the location.

The property must be in the metropolitan cities where reasonable rental demand can be expected.

These cities are specifically Tokyo 23 wards, Yokohama, Kawasaki, Chiba, Nagoya, Osaka, Kyoto, Kobe and Fukuoka.

The property must be within 10 min walk distance from the nearest train station.

Airbnbs and hotels are excluded (meaning it must be a property to rent or your own house)

Interest rate is attractive enough to create the good cap rate.

Japan’s interest rate is historically low due to the quantitive easing by the central bank.

Anyone who is in interested in such loan, please send us a direct message via

contact us.

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and Sell Real Estate in Japan”is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link

Real estate investment Japan : Liquefaction risk caused by earthquake in Tokyo

(Nebuta, Aomori)

Japan is subject to many wind and water related disasters due to the fact that much of the land is steeply inclined and experiences a lot of rain. In addition, typhoons also hit Japan from summer to fall.

Located in an area where many continental plates meet, Japan also experience earthquakes and volcanic eruptions.

Although Japan is a disaster-prone country, there is no need to be overly concerned.

We have some preparation measures. For example, here In Japan, every resident with a mobile phone receives a text message warning of imminent quakes.

Many disasters are small in scale, and Japan has accumulated knowledge on how to deal with disasters through past experience.

Secondary disasters that occur after the quake also characterize major earthquakes. If you and your property are near the coast, there may be a risk of tsunami.

According to an article in Economist in February 2018, in US,

“there is a 10% chance that in the next 30 years an earthquake between 8.0 and 9.0 in magnitude will rupture the Cascadia subduction zone that runs along the coast of Washington, Oregon and Northern California.

US has no early-warning system.

Mexico, Turkey, Romania, China, Italy, and Taiwan all have systems to warn residents of imminent earthquakes.”

My point is that natural disasters could happen anywhere in the world and thus preparation is very critical.

Many foreign investors ask us about the liquefaction risk in Tokyo area.

Today I am going to discuss the risk of liquefaction caused by the earthquake in Tokyo citing the information released by the local governments.

Risks in real estate investment in Japan-natural disaster- : How to avoid the earthquake risk

Japan has the risk of earthquake.

You remember the earthquake in Kobe in 1995 and Tsunami disaster in Fukushima in 2011.

Although Japan’s earthquake-resistant technology of buildings is considerably advanced than that of other countries,

we have to be realistic.

In the interest of personal safety and protecting the value of what is likely your biggest financial asset,

prospective buyers and investors should be aware of any natural disaster risk impacting a potential property purchase.

If the building is broken or collapsed due to an earthquake, you cannot get rent.

In most cases, learning about natural disaster risk will not stop investment, but it will help investors make a better-informed decision about where to buy and preparing in terms of appropriate insurance coverage depending on the type of natural disaster risks most affecting the property.

Unfortunately we don’t have a comprehensive ‘natural disaster risk score’ covering whole Japan announced by the government or a certain institute but on the prefecture and city level, many prefectures and cities

release ‘hazard maps’ to show the risks of natural disasters

in the area.

Read more

How safe is Japan to invest ? and which part of Tokyo you should consider ? -crime rate-

Do you want to buy a house or invest in Japan ?

If you’re considering an international investment property, step one is to find a good real estate agent who understands the country’s regulations,

especially if you’re not fluent in the local language.

Next question is what sort of criteria for judgement do you have in your mind for finding a property ?

If you don’t know what you’re looking for, you’ll never find it.

How about crime rate ?

Good.

Japan is safe.

Having lived in Kobe, Kawasaki, Tokyo, Sydney, Gold Coast, London

and travelled over 25 countries, I can assure it. And crime rates are an important indicator to analyze when looking for an investment property.

Buying the property in a high crime country or area can be risky not only to you, but also to your investment or even to your tenants.

High crime generally reduces the values of properties in a given area.

A study in USA for example, found that a 10 percent reduction in homicides resulted in an 0.83 percent increase in housing values the following year.

Needless to say, people in Japan do care about the safety in the neighborhood.

I am not saying that you can’t make money in areas with higher crime.

There could be a good number of investments in areas with a relatively high crime rate. There are still?plenty of good people in those areas that you can make money renting or selling to.

But the important thing is to know what you are getting into.

It is important up front to decide what kind of risk tolerance you have and what types of areas you are willing to invest in.

But how safe is Japan ?

Once you’ve decided on what kind of areas(countries) you are looking to invest in,

you can start to research them. Always ask Google first.

Here is the some statical data on some developed countries by UN, GLOBAL STUDY on HOMICIDE 2013.

How can you know if your property in Japan is a good investment ?

There are a number of options and variations in the real estate investment opportunities in Japan.

You can invest in the condominiums, residential buildings, flipping the existing houses, flipping the abandoned houses, office buildings

boutique hotels and small hostels so on.

You also have to decide the area you want to invest.

Is it in Tokyo, neighboring areas of Tokyo or local cities which usually offer more attractive yields ?

Each option has both pluses and minuses.

In this article today, however, I will discuss in general what I think a good rental property is and what things to look at when you are considering buying a property for the investment in Japan.

In my opinion, you need to consider the following factors.

Monthly cash flow, the location, the value (appreciation), the condition of the property, the market and your age.

Taxes and other factors need to be considered as well.

Understanding the tax angles when you buy the property in Japan Part-1

Understanding the tax angles when you buy the property in Japan Part-2

Brief on Inheritance tax in Japan as of 2017

Among the above factors, the first thing I look is the monthly cash flow.

Is only Tokyo worth investing in Japan ?

(Fukuoka city: Image was provided by Fukuoka city official site)

As we discussed in the previous post, we always recommend

foreign investors to start looking at Tokyo as the prime location to invest

in properties however, in addition to Tokyo, there are a few big local cities

where attractive investment opportunities exist.

Fukuoka city in Kyushu island is one of them.

Where is Fukuoka city ?

Fukuoka city is one of twelve government-designated cities

(namely large cities) such as Yokohama, Osaka, Nagoya

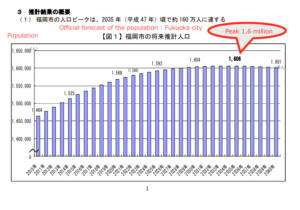

and has a population of 1.53 million people.(vs. 9.21 million in Tokyo 23 wards)

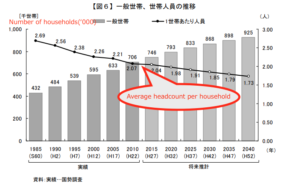

Here is the latest official forecast of its population and household

in the future announced by the Fukuoka city official.

(Please click the image to enlarge)

Its population will increase until 2035 and

notably the number of household (another important indicator for real estate

investing) will continue to grow until 2040 (or possibly beyond)

In Japanese real estate investing, the population matters so their

future is very bright.

Its gross population is ranked 5th in the government-designated cities.

In terms of population increase and population growth rate,

Fukuoka city tops in twelve cities.

From the global perspective, in ‘Livability ranking’ published by

MONOCLE magazine in London, Fukuoka city is ranked

14th in the world.Read more

How is the institutional investor looking upon the Japanese market ?

Many foreign investors may be hesitant to buy real estate in Japan where the declining birthrate

and the aging population are progressing. Compared with the emerging

Asian market such as Thailand and Vietnam,in terms of the macro view, you could be right.

However it is also true that real estate investment should be aimed at

generating stable earnings from a long-term perspective.

It is said that the stability and transparency of the Japanese market is

very attractive for foreign investors.

I mean the market growth is not everything.

Today we will discuss the strategy of a major Japanese real estate

corporation, Mitsui Fudonsan that can be a good measuring instrument to assess the real estate market in Japan.

Individual investors also can leverage such information and better understand

the market in Japan.