Many foreign investors may be hesitant to buy real estate in Japan where the declining birthrate

and the aging population are progressing. Compared with the emerging

Asian market such as Thailand and Vietnam,in terms of the macro view, you could be right.

However it is also true that real estate investment should be aimed at

generating stable earnings from a long-term perspective.

It is said that the stability and transparency of the Japanese market is

very attractive for foreign investors.

I mean the market growth is not everything.

Today we will discuss the strategy of a major Japanese real estate

corporation, Mitsui Fudonsan that can be a good measuring instrument to assess the real estate market in Japan.

Individual investors also can leverage such information and better understand

the market in Japan.

It is a good indicator for judging whether Japan’s real estate market

is attractive or not.

Mitsui Fudosan (Mitsui Real estate)

Mitsui Fudosan is a leading real estate company in Japan with a very long history and listed in Tokyo stock exchange.

Their business portfolio varies from houses for individuals to

development of prestigious apartments (condos) and large office buildings

mainly in Tokyo.

Their corporate mission for the mid term (3-5 years) are :

-Maximize urban value creation by providing secure, safe and attractive urban spaces and soft services that bring enrichment and comfort to urban living.

-Provide variable and innovative solutions that stimulate the real estate investment market.Among seven corporate goals, I pick up the following two agendas

Mitsui will pursue. These are also worth watching

as the small to medium size investors.

1) Create neighborhoods

“To achieve this goal, we will also make optimal use of the Group customer base.We aim to generate new demand by evolving our Smart City initiatives, promoting mixed-use developments that combine a wide array of functions, and further advancing efforts to combine facilities and services to enhance customer satisfaction. ”

Insight :

As Japan is facing the long term problem of shrinking and ageing population,

Smart City initiatives would also create the unique opportunities for the foreign investors as well.

2) Expand the hotel and resort business

“To capture the increased leisure-related demand generated by the maturing society and the opportunities presented by the rising numbers of inbound tourists to Japan, we aim to expand the number of hotel rooms operated by the Group to 10,000 in 2020. At the same time, we are working to develop NemunoSato and other sites into Asia’s top resorts.”

Insight: The following is the article from Financial Times on January 18, 2018.

“There was also robust growth in visitors from Europe, the US and Canada.

Tourists used to regard Japan as too expensive and troublesome to visit.

After 20 years of on-and-off deflation it is more

affordable, while its cultural and language quirks appeal to an ever more globalised world.

The government of Prime Minister Shinzo Abe has also put tourism at

the heart of its growth strategy. Liberalisation of tourist visas for Chinese visitors,

in particular, has contributed to the surge in numbers.

“Tourism has grown rapidly in Japan in recent years.

Japan was considered too expensive, remote and difficult to visit but

Japan already surpassed the goal of 20m annual tourists by 2020 five years early

and it is aiming the new goal of 40m by 2020.

Although the number of tourists are growing rapidly, the number of

accommodation in Japan is not catching up the pace where attractive investment

opportunities are identified.

Demand for real estate for accommodations (hotels and resorts)

continues to rise. Some Japanese banks are starting to offer the

credit line to small developers for financing hotel projects.

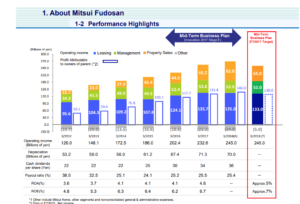

I am attaching the latest financial report by Mitsui below.

As you can see, they have been enjoying very good years

for last several years, which should present some sort

of confidence for small to medium size investors.

(You can enlarge the image by clicking)

Finally I quote the Reuters report about the Norway’s sovereign funds on December 7, 2017.

“Norway’s $1 trillion sovereign wealth fund has made its first real estate investment in Asia

by acquiring a 70 percent stake in five properties in Tokyo and hopes to do more property

deals in the Japanese capital, it said on Friday.The fund will pay

92.75 billion yen ($823.20 million) for its stake, valuing the portfolio

at 132.5 billion yen, while partner Tokyu Land Corporation will

acquire the remaining 30 percent, the fund said.Three properties are

in the shopping district of Shibuya while the two others are

in the upmarket area of Omotesando.”

Toshihiko Yamamoto

Real estate investing consultant and author.

Toshihiko is currently writing a book about the real estate investing in Japan

for foreign investors.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and a MBA from Bond University in Australia.