Tokyo Condo Market Soars Again in June — Driven by Core Wards and Luxury Segment

Source: Based on Tokyo Kantei Report (Released July 24, 2025)

1. Greater Tokyo Area Sees 11th Straight Month of Price Increases

According to the latest market data from Tokyo Kantei, the average asking price for a 70 sq.m. used condominium in the Greater Tokyo Area rose to JPY 58.51 million in June 2025 — up +3.0% from May and continuing the strong upward trend seen over the past year.

-

Tokyo Metropolis: +2.6% MoM to JPY 88.26 million

-

Kanagawa Prefecture: +2.0% to JPY 40.15 million (first time surpassing the JPY 40M line)

-

Saitama & Chiba: Continued stable growth at +1.8% and +0.9% respectively

The sustained increases reflect firm demand, limited new supply, and Tokyo’s growing weight in overall transaction volume.

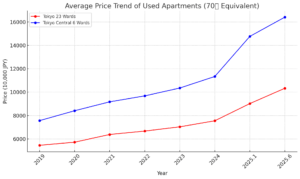

2. Tokyo 23 Wards: High-End Segment Pulling the Market

The average price in Tokyo’s 23 Wards reached JPY 103.33 million in June, up +2.4% MoM, with year-on-year growth approaching 40%. This growth is largely due to a rising share of luxury, newer listings concentrated in central districts.

-

Central 6 Wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo, Shibuya):

-

JPY 164.15 million (+0.5% MoM)

-

29 consecutive months of price growth

-

Early signs of price resistance appearing due to increased inventory

-

-

Other 17 Wards:

-

Broad-based MoM increases between +2.0% and +3.5%, showing depth in demand

-

3. Osaka and Regional Cities: Differentiated Trends

-

Osaka :

-

+2.8% MoM to JPY 80.07 million — a record high

-

Outpacing even Tokyo in YoY terms (+37.2%)

-

Strong momentum continues, especially in business districts

-

-

Nagoya :

-

–0.7% MoM to JPY 39.27 million

-

Suggests a plateauing trend despite earlier gains

-

4. Structural Trends: Luxury Resilience, Suburban Recovery

Tokyo Kantei’s data reveals several ongoing structural dynamics:

-

Continued divergence between core and outer markets, but both rising

-

Inventory build-up in ultra-luxury segment, especially in Central 6 Wards

-

Suburban affordability driving buyer activity in Saitama, Chiba, and western Tokyo

-

Osaka showing sustained investor interest, led by central district projects

These dynamics reflect a market still driven by scarcity, investor confidence, and urban migration.

5. Political Signals: Possible Future Shift in Foreign Ownership Policy

While the Tokyo real estate market remains robust, it is important to monitor Japan’s evolving policy landscape.

In the recent Upper House election, Japan’s ruling Liberal Democratic Party (LDP) suffered notable losses. In contrast, conservative parties such as the Democratic Party for the People, Sanseito, and the Japan Conservative Party — all of which publicly support restricting foreign property ownership — gained ground.

This may signal upcoming legislative developments aimed at tightening foreign access to Japan’s real estate market, especially in strategic or high-value areas.

For foreign investors, the current regulatory environment remains permissive, but timely entry may be prudent.

Conclusion

Tokyo’s condominium market continues to show remarkable resilience and strength — especially in luxury segments and key central wards. While political developments warrant close observation, fundamentals remain intact.

At Yamamoto Property Advisory, we continue to monitor both market dynamics and policy shifts to advise our global clients with timely, data-driven insights.

Thinking of Investing in Japan?

At Yamamoto Property Advisory, we provide bilingual, data-driven support to global investors entering Japan’s residential and commercial property markets.

Whether you are looking for a Tokyo penthouse or a long-term income asset, contact us for discreet, strategic guidance.

Contact us or yamamoto@yamamoto-property.jp

Source:

-

Tokyo Kantei : “Condominium Price Trends” (July 24, 2025)

-

Author analysis & commentary

#TokyoRealEstate #JapanPropertyMarket #TokyoCondoPrices #CentralTokyoApartments #ForeignInvestmentJapan #TokyoKanteiReport #JapanHousingTrends #LuxuryRealEstateTokyo #OsakaRealEstate #JapanesePropertyLaw

Toshihiko Yamamoto is the founder and principal broker of Yamamoto Property Advisory, a distinguished real estate brokerage in Tokyo that specializes in luxury residential and investment properties for an international clientele. His firm caters to discerning investors seeking premier properties for personal use and income-generating whole buildings for investment purposes.A licensed realestate broker in Japan, Mr. Yamamotoholds an MBA from Bond University in Australiaand a Certified Commercial Investment Member (CCIM) designation from the CCIM Institute in the United States. His extensive international experience, having lived abroad in Australia and the United Kingdom, equips him with a nuanced understanding of global real estate trends and the unique needs of foreign investors.With over two decades of experience in international business, Mr. Yamamoto has successfully conducted business with clients from more than 20 countries. As a seasoned property investor himself, he provides informed guidance to his clients as they navigate the intricacies of the Japanese real estate market to secure optimal investments.Discover more in his book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage, and Sell Real Estate in Japan,” available on Amazon, iBooks, and Google Play.Connect with us through social media on Instagram, WhatsApp, and LINE for further information and expert assistance.

About the book

Amazon.com Link