(Yokohama city center)

Evaluating Real Estate as an investment

According to an article in USA today, single-family homes in large U.S. cities have generated returns of about 9% annually on average,

according to the study, which examined results from 1986 to 2014. Yes, there are risks in real estate investment.

Becoming a landlord isn’t without its risks — from bad tenants and periodic market slumps to changing tax laws and natural disasters

such as tsunami and earthquake.

The principle and the mechanism of the real estate investment in Japan is exactly the same

as other countries.In theory, you borrow the money at 3% from a bank and buy the real estate that generates 8% yield.

The spread (in this case 5%) is your profit.

You don’t need the rocket science. But really ? Let’s find out how viable it is.

In financial parlance, it is called ‘leveraging’.

Leveraging does not necessarily mean success.

Skeptics about the real estate investment in Japan where the population is

declining and rapidly ageing have lots of ammunition.

Leverage magnifies all of your returns and those returns aren’t always positive!

If you want to make investments where you can expect the appreciation of 20% over next 3 years,

Japan is not your destination.

You would be better off going to the emerging economies in other part of Asia.

But don’t forget that the laws and regulations in

these countries are not usually robust enough to protect your investments.

Those doubting the real estate investment in Japan

have been proved wrong in the past 10 years.

Real estate in Japan is different from most other investments in that you

could borrow (finance) the entire cost of the asset, plus all of the significant associated

purchase costs (such as stamp duty and registration cost)

if you are working for a company as salaryman and have small cash and assets.

You would be amazed how much you can borrow from a Japanese bank for the real estate investment.

For some reason, Japanese banks are very willing to lend the money to

finance the real estate investment to people who work for a company as a full time employee (正社員).

And if you are working for a reputable and prestigious multinational corporation, your credit line

would be more massive.

However, please don’t thinks any bank will be happy to finance your deals.

Each bank has its own criteria and preference for the location of the property.

Therefore before you start looking for a property to invest, you need to find a bank for your financing and understands their criteria.

We have already established the good relationship with a few banks who are active in the financing the real estate investments.

If you are a foreigner without PR status or residing abroad, only a few banks can provide the loan for you.

Our strategic business alliance with a prominent Japanese bank who can provide the loan for non-residents might be able to support you.

If you are a non-resident foreigner who requires the loan from a Japanese bank,

we need to carefully examine the potential measures to secure the loan for you.

The loan can often amount to as much as 110 per cent of the

actual purchase cost of the property.

Thus, you can use a small deposit to buy, own and control a much larger investment.

Compared with most other investments, real estate can excel at producing income for property owners.

So, whilst you can’t rely on the longer term appreciation in Japan,

you can earn stable income year in, year out.

The best part about capital growth is that you don’t have to pay any tax on it until

you sell the property and pay capital gains tax unlike any positive income from the property,

on which you have to pay tax each year.

Real estate can be both a true growth and income investment.

The growth in value of your properties compounds over years of hold.

The best part about capital growth is that you don’t have to pay any tax on

it until you sell the property and pay capital

gains tax unlike any positive income from the property, on which you have to pay tax each year.

If you have property that you rent out, you have money coming in every month in the form of rent.

When you own investment real estate, you also incur costs that

include your mortgage payment, agent fees, land tax, insurance and maintenance.

It’s the interaction between incoming revenue and outgoing expenses.

I personally like a residential property because it can be an attractive real estate investment for many people.

Residential property is easier to manage than most

other types of property, such as industrial and retail property.

If you already own a home, you have some level of experience buying and maintaining residential property.

Case study (crude projection)

(Case study property in Yokohama)

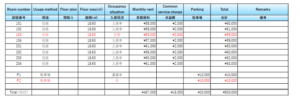

As a case study, let’s look at a specific investment case which we recently dealt

with a Japanese salaryman investor.

It is a residential property

Property

Residential building with 2 stories8 apartmentsWood structureBuilt : 2007

Location : Kounan-ku, Yokohama city (横浜市港南区)

Station : Kaminagaya station (上永谷)Yokohama blue line

(10 min walk from the station)

From Kaminagaya station:

20 mins train ride to Yokohama station

40 mins train ride to Shinagawa station

Land : 260 square meters

Building: 174 square meter

8 studios (18 square meters) each and 2 parking lots

Price

88 million yen

Finance (mortgage loan)

by a prime Japanese bank

91 million yen (U$910,000)

Mortgage rate

2.4% pa for 28 years

The bank finance shall cover the property as well as the initial cost.

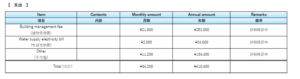

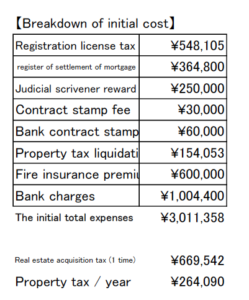

Initial cost

4 million yen (U$40,000)

This covers the initial cost such as Real estate acquisition tax (669,542 yen),

Property tax (264,090 yen),

Registration license tax (548,105 yen)

Stamp duty, bank charges, Fire insurance, Judicial scrivener fee and so forth.

Gross Yield (basis 100% occupied): 6.86%

Crude monthly cash flow projection (basis 100% occupied)

Rent : 503,000 yen

Mortgage repayment : 372,210 yen

Building management fee : 23,000 yen

Rental management fee : 21,730 yen

——

Balance : 86,060 yen (U$860)

Yearly cash flow : 1,032,720 yen (US$ 10,3200)….. (1)

Even If you have repair cost say 500,000 yen, you are

still in surplus.

Main cost to manage the property per year

————

Property tax : 669,000 yen (yearly, tax-deductible)

Building management fee : 276,000 yen

Property management fee :260,760 yen

Plus occasional repair cost : 500,000 yen (est.)

(current rent income)

(monthly cost projection)

Tax implication

Unlike the stock trading, the government allow investors to opt for the offsetting

— or netting — between salary income

and the profit or loss from the real estate investment.

Almost all the cost such as tax on real estate, interest payment on loan, repair cost,

management fee can be subtracted

from your sales (rent income) reducing your tax obligation.

Another benefit is the depreciation of the building.

But depreciation is different.

Depreciation is the process by which you would deduct the cost of buying or

improving rental property.

Depreciation spreads those costs across the useful life of the property. Rather than take a single, large tax deduction

in the year you bought the property, you would take a portion of the cost of the building

as a smaller depreciation deduction each year.

Meanwhile, in Japan’s tax system, the total life of each building construction type for depreciation calculation is defined as follows.

RC(reinforced concrete) : 47 years

Steel : 34 years

Wood : 22 years

If you buy a two-years-old RC property, you will spread the cost of

building (building only, you can not depreciate the land) for 45 years.

If you are working for a company and paying income tax,

you can log claim the expenses in your income tax report (kakuteisinkoku 確定申告)

Let’s look at a simulation of profit and loss for a year based on this property

Your property : 88 million yen

P/L

Rental income : 6,000,000 yen

Operating cost : 540,000 yen

Property tax : 260,000 yen

Mortgage interest :2,000,000 yen

Depreciation : 2,500,000 yen

Repair cost : 500,000 yen

Other cost : 1,000,000 yen (est.)

—

Balance : (800,000 yen) *negative

You might think why someone wants to make an investment to lose money. It would not make any sense ?

But this calculation is only for tax obligation purpose and the depreciation is only accounting loss

because you have paid for the property at time of purchase. It is the cost factor on the profit loss statement but does not

take any cash out of your pocket. Your cash flow has been analyzed as (1).

This paper expense of depreciation (2,500,000 yen) can “shelter” or protect other income from taxes and reduce your tax bill. The amount of the depreciation decreases as the year goes by but you are able to be shelter your income from taxes over 22-47 years depending on the construction of your property.

And you also want to note that in the income tax report of the first year, the tax implication is very different because you

have the initial transaction cost (see the attachment)

(initial cost)

In this case, you have incurred cost of 4 million yen (3 million +1 million)

As I mentioned, you are allowed to opt for the netting.you can compress your salary income by logging

the expense of 4 million yen in the first year.

Let’s suppose you are earning 10 million yen from your salary.

Depending on your family situation

but your taxable income would be around 6 million yen.

You are on average liable for 1.2 million yen income tax (20% x 6 mil)

plus 600,000 yen inhabitant tax. (10% x 6 mil yen) minus 400,000 base tax break

Balance : 1.4 million yen

Meantime, if you can compress your taxable income down to

2 million yen (6 mil minus 4 mil) you can have quite nice tax benefit.

Because your taxable income at 2 million yen would bring you roughly 100,000 yen tax obligation only. You should be able to save 1.3 million yen(1,400,000-100,000).

Depreciation can be a valuable tool if you invest in rental properties in Japan because it allows you to spread out the cost of buying the property over decades, thereby reducing each year’s tax obligation. (when you sell it you will owe tax on the gain)

Final thoughts

Case study

Pros

Location is good

Quite new building

Wood structure (low maintenance cost)

Depreciation period is short (sheltering amount for each year is relatively large, which means you can save more tax in shorter time of period)

Studios for single-households should meet the market needs

Full financing at low interest rate is available (Very rare. No cash down payment)

Cons

Long term strategy remains to be seen (shrinking population, economy etc)

Not 100% occupied at the moment

Monthly cash flow is not very strong

You might think it is too good to be true or troubling ?

As I said earlier, becoming a landlord isn’t without its risks.

However, the interest rate is at the historically low level in Japan and a prosperous property does not require your cash down payment.

By taking full advantage of your ability to leverage, you could comfortably buy a property to rent in Japan for your wealth-building strategy.

If you are interested, please do not hesitate to contact us.

We will provide more details and some other listings.

From JLL web site

Tax Depreciation

Depreciation for a building can be deducted as a necessary expense from the amount of income from real estate for Japanese tax purposes. The amount of the deduction depends on the useful life of the property concerned and the depreciation calculation methodology used. The length of the useful life of a building depends on the physical construction of the property. Cost of land cannot be depreciated.

Other Helpful Articles About Tax in Japan

(Yokohama port)

Toshihiko Yamamoto

Real estate investing consultant and author.

Toshihiko is currently writing a book about the real estate investing in Japan

for foreign investors. About the book

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and MBA from Bond University in Australia