(Nomizo -no-taki(Nomizo fall), Chiba pref)

Is a tidal wave finished in Japan ? It is about time to to buy a property ?

Japan’s one of the major online web sites for the investment properties ‘Kenbiya’ recently announced the latest market trend on the properties that are registered on the site in Japan.

It is not an official report by the public sectors but the research shows the quick snap shot of the market trend.The research results cover the period between April 2018 and June 2018

on properties in Japan for each market segment.

Let’s take a closer look at the result.

Overview on all Japan

Condo unit

The gross yield of registered properties is almost unchanged at 7.69% ( minus 0.02 points compared with the previous term).

The average price fell slightly to 14.24 million yen (-3.85% from the previous term).

Residential apartment building

The gross yield of registered properties rose slightly to 8.91% ( plus 0.13 points). The average price is 67.4 million yen ( minus 2.06% from the previous term).

The average price for the apartment buildings declined for the first time since 2013.

Residential condo building

Registered yield slightly increased to 8.06% (plus 0.09 points).

The average price slightly went up to 16,329,000 yen (plus 0.66%)

Here is some more information on properties in greater Tokyo (Tokyo, Kanagawa, Saitama, and Chiba) area.

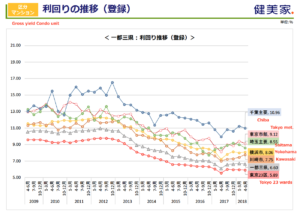

Please see the chart below showing the general trend of the gross yield in greater Tokyo from 2009 to 2018 by Kenbiya.

As you can see the yield of the condo unit has been steadily declining (which means the price of the property has been going up)

since late 2012 but the yield curb is flattening over last 1.5 years and short-term trends is signaling the yield has hit the bottom.

(Yield curb of condo unit)

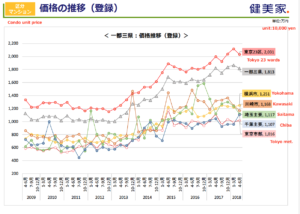

(Price chart of condo unit)

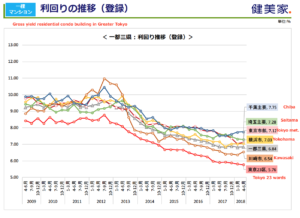

Meanwhile, as I said earlier, the yield of residential buildings is declining in short term and it is the first decline since 2013.

(Yield curb of residential condo building)

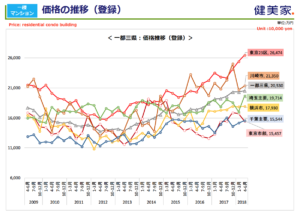

(Price chart of residential condo building)

After Suruga bank and Kabocha-no-basha scandal, the banks are clearly tightening the financing the individuals investors and without the backing of banks,

the real estate transactions for the market segment are facing the difficulties.

The market is under downward pressure.

I am attaching the full report by Kenbiya.

kenbiya report

Other helpful articles

Where is the most attractive city to invest in Asia ? : CBRE institutional investors reports 2018

Real estate investment : Is Tokyo’s property bubble finally ready to burst ? (if any)

Final thought

Some pundits are loud about the highly publicized real estate crisis (due to the shortage of financing) but it is not standing up to be seen.,

The tightening of the loan for the investment is certainly giving some negative impact for some market segments but it is accelerating the end of the booming which we have seen over 5 years.

The market will NOT crush but it seems that the market is entering the consolidation stage.

(Kujukuri-hama (Kujukuri beach) in Chiba pref.)

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and Sell Real Estate in Japan”is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link