If you are seriously interested in the real estate investment in Japan, the hotel segment is growth potential.

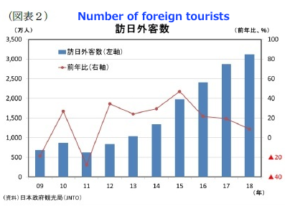

The number of foreign tourists to Japan is set to rise for the seventh straight year and hit a record level of

more than 30 million in 2018.

(Chart : Number of foreign tourists, unit: 10 thousand)

The government is targeting 40 million foreign visitors by 2020, when Tokyo will host the Olympics.

Japan accepted an all-time high of 28.69 million foreign visitors in 2017, up 19.3 percent from the previous year

and the number of visitors are still on rise.

The estimated number of foreign visitors to Japan in February 2019 rose 3.8 percent from a year earlier to a record 2,604,300,

but the growth in Chinese tourists slowed.

By country and region, the highest number of visitors came from China at 723,600, up 1.0 percent from a year earlier,

according to the Japan Tourism Agency.

However, the pace of growth slowed from 19.3 percent in January with a declining number of cruise ships making stops in Japan.

South Korea was second at 715,800, up 1.1 percent, followed by Taiwan at 399,800, down 0.3 percent, and Hong Kong at 179,300, up 0.5 percent.

The number of visitors from Southeast Asia jumped in February, with Vietnam marking a 68.6 percent leap to 39,400,

Thailand up 31.4 percent to 107,800, and the Philippines up 28.0 percent to 35,200, according to the agency.

On a yearly basis, the number of foreign tourists visiting Japan surpassed 30 million in 2018.

And yet, Japan has the population of 126 million.

Thus 30 million is a huge number.

The number of visitors dropped once in September 2018, but then recovered steadily thereafter,

and inbound tourism is the very hot topic in terms of real estate, too especially accommodation segments.

In fact, recently we can see foreign tourists everywhere in every city, and it has been clearly expanding,

but in the long run, how does the booming tourism affect the real estate industry ?

The Nissei Research Institute(Japanese Think Tank) recently published the interesting report about the impact on the real estate industry

caused by the increasing foreign tourists.

Today I am going to summarize the report by Nissei Research Institute which was announced in February 2019.

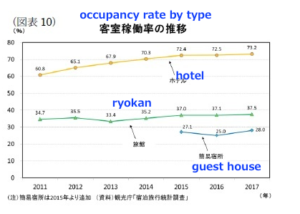

One of the interesting points in the report is ‘the estimates of occupancy rates of for lodging facilities types

(hotels, ryokan and cheap lodging or guest house) by each prefecture.

It says that hotel construction advances with inbound tourism expansion, and in some areas there already is an excess of supply.

What does it mean ? Are the hotels already resupplied ?

The report points out some very important points that we tend to overlook.

Certainly, the number of foreign tourists is increasing, but from now on domestic tourists, which account for more than 80% of the present guests,

will decrease due to population decline and aging.

As a result, there may be more differences in the occupancy rates in various areas that are already showing the patchy picture.

By the way, it is said that the hotel room occupancy rate is the highest at 86.5 per cent in Osaka in 2017,

(This rate means almost full everyday) whereas the rate is below 50 per cent in places like Nagano and Yamanashi.

In the meantime, by types of lodging, the number of traditional Japanese style hotels (called ‘ryokan’, Japanese inn) is decreasing every year

the number of western style hotels and cheap lodging style accommodation (called ‘kan-i-shukuhakusho’ or guest house) are on the rising trend.

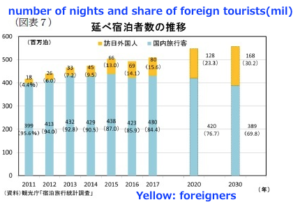

In terms of regions (cities vs. regional), currently the number of visitors in the three major metropolitan areas (Tokyo, Osaka and Nagoya) and

other urban areas are steadily growing but the regional areas are showing even higher growth rate.

The share of the number of visitors in the regional areas was 33.5 per cent in 2011, but it has increased to 41.0 per cent in 2017,

and has been flat since then. To revitalize the economy in regional areas, the government aims for a share of 50 per cent in 2020 and 60 per cent in 2030,

and whether the government target can be achieved or not would in part rely on the development of the hotel industry in such areas.

(data of number of nights tourists stayed and share of foreigners)

The report estimates the number of rooms used and the occupancy rate in 2020 and 2030 using various data.

First of all, according to the national forecast, the number of guest rooms

in any accommodation facility will increase in 2020 and 2030 from 2017 (I know it is obvious)

, and the decrease in domestic travelers due to population decline and aging will be compensated by inbound.

Therefore, if we are based on the same number of accommodations as of 2017, the occupancy rate in the hotel will inevitably

rise to less than 80per cent in 2020 and the sense of shortage will increase.

But the reality is different.

It is forecasted that there will be opening of 138,000 new rooms by 2020.

If you include the new rooms, the operating rate will be lower in both 2020 and 2030 than in 2017.

On a entire Japan basis, with the number of new hotel constructions, the number of rooms in 2020 will be more or less meeting or

even exceeding the demands.

Now let’s look at the forecast by prefecture.

Unfortunately, there are some prefectures that can not compensate for the decrease in domestic tourists with the increase in the number of foreigners visiting Japan,

and the regional differences will be widening.

The number of occupied guest rooms will decrease in 12 prefectures in 2020 and the same situation will occur in even 20 prefectures In 2030.

In fact, the number of rooms occupied has already decreased in Akita

, Fukui , Nagano , Tottori , and Kochi from 2011 to 2017, which indicates that the benefits of

foreign tourists expansion has little affect.

On the contrary, where is the shortage expected?

Tokyo and Osaka will face the shortage in 2020 and as of 2030, additional rooms will be needed even in Hokkaido, Chiba and Okinawa.

On the other hand, Kyoto’s 11,000 hotel rooms are scheduled to open by 2020, an increase of 41per cent over the number of rooms in the 2017.

Kyoto is already over-supplying the hotels.

*I visited Kyoto last December and found there were so many new hotels being opened.

I did not face the difficulty in booking a hotel, which was quite problematic a few years ago.

Particularly in Kyoto, even now the decline in earnings has caused the number of cheap lodging facilities to go out of business.

Recently Kyoto is so crowded that people are being reluctant to get there.

You see the different story in Nara.

There is hope for Nara, where there have been so few accommodations.

It is planned that the number of rooms in Nara will exceed the past pace in the future, but it is a place where the number of

rooms is the lowest in the country, and there are abundant tourist resources.

Depending on the effective marketing effort, it may still grow.

Especially if Kyoto is too crowded to go together with various ways, foreign tourists may review Nara as a new spot.

Like Nara, ryokan segment is also interesting in the sense of future growth.

It is expected that the occupancy rate of ryokan will rise in Hokkaido, Tokyo, Osaka, Oita and Okinawa in the future, and will be highest

at 81.1per cent in 2030, 70.7per cent in Tokyo and 58.8% in Oita.

Among foreigners visiting Japan in Tokyo, Osaka and Okinawa, only 1.3 per cent tourists chose to stay in ryokan, but in Hokkaido and Oita,

the choice is supported and it is showing 20 percent level and 40 per cent level respectively.

In other words, if we can direct the eyes of visiting guests to ryokan and get over the language barrier etc, it would be possible to secure the foreign guests

with the charm that is not found in hot springs and other western type hotels.

Lastly, on the cheap lodging (kan-i-shukuhakusho,簡易宿泊所) segment, the fluctuation is not so large compared to other types of

accommodation facilities, but some areas such as Gifu, Kyoto, Osaka, Kagawa would see greatly

increased occupancy rates. Like ryokan, there is a gap between areas will prevail depending on how cheap lodgings attract more foreign tourists or not.

In any case, regional disparities and facility disparities by type are larger than we would expect.

If you think of investing in accommodation facilities(such as ryokan and kan-i-shukuhakusho), you may want to carefully examine

the areas and their business conditions before you build the strategy.

(Occupancy rate by type)

FINAL THOUGHT

Assuming that there are 40 million foreigners visiting Japan in 2020 and 60 million in 2030, it can be expected that the number of guests will

cover the decrease in domestic tourists due to population decline and aging.

With regard to accommodation facilities, hotels in Tokyo and Osaka will require additional 22,000 rooms and 14,000 rooms by 2020, respectively,

but construction of hotels that exceed this scale is already planned.

Therefore there will be no shortage of accommodation facilities in Tokyo and Osaka.

The occupancy rate remains high even with the increase of the hotel construction in the future, and it is planned to meet the rapidly

increasing demand.

On the other hand, Kyoto will also need an additional 3,000 rooms by 2020, but hotel construction is expected to

significantly exceed this scale, which may lead to oversupply.

In Nara and Shimane, hotel construction is planned to greatly exceed the pace of increase in the past, and it is necessary

to further attract foreign and domestic guests.

By types of accommodation, although the rate of occupancy of ryokan remains flat with the drop in domestic travelers

complemented by the decline in domestic tourists,.

But the number of rooms continues to decline, and the occupancy rate would vary significantly by the area.

Areas where the share of visiting foreigners is high would enjoy a good time.

Even so, the occupancy rate pf ryokan is lower than the western types of hotel.

Currently, foreigners visiting Japan occupy about 10 per cent of accommodations, but there are also survey result

that about 70 per cent of foreign tourists visiting Japan wish to stay at ryokan.

Despite severe competition due to an increase in western style hotels with high share of foreigners staying in Japan and cheap lodgings,

ryokan could survive if they receive more foreign tourists.

When the supply and demand of hotels are tight, it is a good weapon for a unique accommodation experience in Japan

The demand of visiting foreigners who wish to experience the traditional stay in ryokan has the potential to grow.

More effective utilizing of ryokan will lead to the spread of the inbound area to the local districts and it would

combat the shortage of rooms.

Nissei Research Institute original report (in Japanese)

P.S.

Final final thought

The government introduced very strict laws governing the airbnb business in June 2018.

The maximum operating days allowed is now 180 days per year and some local governments even

have capped at only 70 days in some areas, which made the industry half dead.

Considering this new blow to the aibnb segment, ryokan investment is very promising.

If you buy a decent ryokan, it comes with hotel license which allows you to operate 24/7.

The caveat is the renovation cost after the investment and business conditions in the locations

where you are seeking.

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and Sell Real Estate in Japan”is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link