In light of the surging inbound tourists, Japanese and foreign developers and hotel companies have stepped up construction, with names like Hyatt, Marriott, Nomura Real Estate Development and Mitsui Fodosan building new accommodations.

We have been increasingly receiving the inquiries from overseas investors about the properties in Kyoto for vacation rentals.

Generally speaking, lots of investments money to build the hotel and private lodging are flooding in Kyoto now from both inside and outside Japan and therefore the good properties with hotel license tend change hands very quickly.

There are very attractive investment opportunities for foreign investors in Kyoto properties.

I am going to discuss the opportunities of vacation rental in Kyoto today.

Let me start with the recap on the inbound tourism market in Japan, in particular, Kyoto.

The number of foreign visitors to Japan rose 19% to a record of nearly 29 million in 2017.

The government set the road to the target of 40 million by 2020 when Tokyo will host the Olympics.

Spending by foreign visitors rose 18% to ¥4.4 trillion ($40 billion).

Tourists have transformed the face of the nation’s cities, crowding into popular destinations such as the Ginza shopping area in Tokyo, temples in the ancient capital of Kyoto and ski

areas during the winter.

For example, the number of American visitors rose 11% in 2017 to 1.24 million which accounts for about 4% of the total.

In Japan, there are simply not enough rooms with hotels in the so-called Golden Route of Tokyo, Osaka and Kyoto experiencing high occupancy well over 80 percent.

Kyoto particularly facing the very tight supply and demand situation in the accommodation.

The tight supply prompted the Japanese government and corporations to step up activity in the arena, developing the hotels in large cities. A private consortium together with the local government in the rural locations also set up a new fund to invest in aging, traditional accommodation, called “kominka“.(traditional Japanese style house)

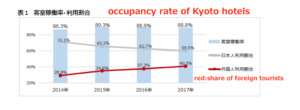

In the meantime, the Kyoto City Tourism Association recently released

the statistics of the tourism in Kyoto as well as the result of the survey on

hotel occupancy rates in Kyoto.

The survey of 36 major Kyoto city hotels showed that foreign tourists accounted for 40.5 percent of her total guests in 2017.

It is the highest figure recorded since the survey began in 2014.

Room occupancy rates of major hotels in Kyoto City was 88.8% according to the same survey.

The foreign guests accounted for 40.5% of total guests who stayed in Kyoto, rising 3.2 points from the previous year, exceeding the 40% mark for the first time since the survey began.

The survey is based on the number of rooms, and covers 36 hotels (about 9361 rooms), which is about 40% of Kyoto city.

Kyoto city attributes it to an increase in the number of LCC flights connecting Kansai airport and other cities, especially cities in Asia as well as the global economic boom.

Looking at visitors who stayed by country / region, China accounted for the largest share 23.9%, 1.4 points higher than the previous year.

China tops the list for the second consecutive year.

followed by Taiwan 18%, the United States 12.5% South Korea 5% and Hong Kong 4.7%.

Notably, according to Kyoto City Tourism Association, British hotel data service company, STR, statistics say the average room price of hotels (RevPAR, Revenue per Available Room) in Kyoto city rose by 3.7% from the previous year, which is the largest growth among major cities such as Tokyo (+1.9% ) and Osaka (-1.0%).

Kyoto’s RevPAR growth is also significant in the global perspective.

New York : +3.1%

Singapore : +0.4%

Hong Kong : +7.7%

I guess Hong Kong’s strong growth in 2017 mainly attributes to the extreme price hike of the real estate.

In 2016 STR report, Kyoto was one of the top cities in the world in terms of the RevPAR growth rate.

Kyoto : +9.8%

Osaka : +2.1%

NY : -12.3%

Paris : -26.7%

Here is the top 10 ranking of the number of tourists by country who have visited Kyoto in 2016 and 2017. (ranking by market share)

2017 ranking and market share 2016 ranking and market share

|

1.China 23.9% |

1. China 22.5% |

|

2. Taiwan 18% |

2. Taiwan 20.3% |

|

3 .USA 12.5% |

3. USA 13% |

|

4. Korea 5.0% |

4. Australia 4.3% |

|

5. Hong Kong 4.7% |

5. Hong Kong 4.3% |

|

6. Australia 4.6% |

6. Korea 3.6% |

|

7. UK 3.2% |

7. UK 3.3% |

|

8. Spain 2.7% |

8. Spain 2.8% |

|

9 France 2.5% |

9. France 2.7% |

|

10. Italy 2.4% |

10. Italy 2.7% |

Korean guests increased significantly in 2017 and Germans are not

in the top 10. (German’s share is only 1.5% after Singapore 2.0%.

Kyoto in fact has the very unique mixture of the foreign guests.

Proportionally, Kyoto welcomes more western guests (including Aussies) than Japan average of the total.

Specifically, if you look at the Japan total the number of guests from foreign countries, the western countries account for only 13.5%, however, the same account for 35.5% in Kyoto.

Proportion of western guests in Kyoto is three times more than that of total Japan average.

What are the implications ?

1. Asian people are relatively new to the vacation in overseas countries. and

they have just started discovering the beauty of Japan.

Majority of Asian tourists are in the early stage to explore the cities

other than Tokyo or Mt. Fuji

2.Kyoto was once called Heian-kyō in 700s and was a scaled replica

of the then Tang capital Chang’an (ancient China)

For Chinese tourists, it may not be much appealing.

3. Asian tourists are more interested in shopping as they can find

very unique things in Japan but Europeans and Americans are

more sophisticated and want to spend time to learn the culture and

architects in Kyoto.

4. Kyoto should have more room to grow in spending budgets

on accommodations by western tourists because western tourists

without a doubt, spend more money on accommodations and foods than Asians.

5. Occupancy rate in Kyoto’s hotels is much higher than that of

other cities in Japan, which naturally generates better opportunities in vacation rental properties.

6. The caveat is the huge wave of the excessive investment in the hotel

industry in Kyoto. The excessive sign is not detected yet as the occupancy rate in Kyoto hotels

has been very steady hitting well over 80% for the last few years. (See the chart)

(Source is the Kyoto City Tourism Association. Please click to enlarge the image)

*

– I am not saying Kyoto is not popular among Asian people as Chinese

tourists tops the list.

– I wonder why Germans are not visiting Kyoto as many as they should.

Maybe our effort to welcome more Germans is not made adequately.

In the meantime, we have been listing the following two properties in Kyoto in the closed network for both Japanese and foreign investors.

The information is valid as of March 28, 2018 and the properties

may change hands soon after this blog post.

The following two properties will be fully hotel licensed(簡易宿泊所) and are not categorized as ‘minpaku’ (private hotel lodging).

They are not therefore subject to the recent change of legislation setting rules on the practice of renting out private lodging (minpaku) to tourists.

The measure is originally designed to respond to a sharp increase in the number of inbound tourists by accommodating them in private residences, while preventing potential troubles involving lodgers, owners and neighbors.

Local governments, which will oversee minpaku businesses in their areas, need to make adequate preparations and the said law for minpaku will be effective from June 1, 2018.

1) Guest house-A

In Nakagyo-ward in Kyoto city for vacation rental

Title : ownership under the Japanese law (both land and building)

8 mins walk from the nearest JR station.

15 mins walk from Nijo castle which is one of the

most popular tourists spots in Kyoto.

Price 35 million yen (about U$333,000)

Land 34.72 square meters

Property (house) 37.87 square meters with 2 stories house

Wooden structure

Built in 1976 (fully renovated to obtain the hotel license)

The property is currently fully licensed for the hotel operation and

the established operating company shall be nominated upon fixture.

According to Airbnb, a 2-3 bedroom home in Kyoto can bring in

- 11,000 yen to 14,000 yen per person per night.

- 4,015,000 yen 5,110,000 yen per year per two persons at 50% occupancy.

This can bring you the gross yield of 11.5% to14.6% before the operating cost and tax.

That’s not a bad side income for a relatively low investment – but your potential is actually higher.

Typically, operating companies in Kyoto charge about 20% of the rental revenue as the management fee.

The caveat is the real occupancy rate of the property.

(The picture of the guest house)

2) Newly built guest house-B

In Nakagyo-ward in Kyoto city for vacation rental

Title : ownership under the Japanese law (both land and building)

It is not the typical real estate deal.

The contract is in a form of so-called ‘building contract’ where

the construction company is responsible for acquiring the

the land and building the new property on the land.

It is a very common contract when building the new house in Japan and a kind of the turn-key project.

The construction company

will deliver the property (land and the newly built guest house) upon

completion of the construction.

6 mins walk from the nearest JR station.

Price 64.80 million yen (about US$617,000, land 40.80 million yen+house 24 million yen)

64.80 million yen includes the cost of the construction.

Land : 74.56 square meters

Two old properties are now existing on the land

but they shall be demolished and

the completely new guest house for vacation rental will be built.

Wooden structure

The new property will be designed to fulfill the regulations to obtain the Kyoto hotel license and therefore will be fully licensed for the hotel operation from the beginning.

The operation company shall be pre-fixed.

The operating company will guarantee 378,000 yen rent per month

regardless of the actual occupancy for 10 years.

(This type of the contract is called ‘sub-leasing’)

As the monthly rental is guaranteed by the operating company

the property is expected to generate 7% gross yield on 64.8 million yen investment.

If the investors are Japanese or foreigners with the permanent residence,

ORIX bank may be able to finance the deal by mortgage loan with 20% down payment. (All subject to the financial status of the investor)

The construction company and operating company are

both prospectively incorporated and investors cannot change the players.

But if the investors would like to take the risk of occupancy rate, we will be happy to negotiate with

the seller about the structure of the contract.

The seller will be the construction company who partners

with the operating company (for vacation rental management) for the deal.

They are both very reputable Japanese companies.

If the construction company(seller) fails to obtain the hotel license,

the deal will be void and the deposit and downpayment (if any) will be returned.

In this sub-leasing deal, the caveat is the counter part risk of the construction company and the operating company.

And we can discuss in greater details before entering the contract.

Both of them are solid and reputable companies but If the investors are naive about managing the counter part risk, we strongly recommend

not to buy the property.

(Impression of designer. Please click to enlarge the picture)

If anyone is interested in purchasing the two properties, please let us know via contact us.

We can provide more detailed information.

You can find the 2017 report by the Kyoto City Tourism Association.

Kyoto city tourism association announcement

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and Sell Real Estate in Japan”is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link