Now, the real truth about the real estate market in Japan !

I am often asked about the trend of the real estate market in Japan.

The most common question is

“Is it going to come off after Tokyo Olympics in 2020 ?”

What do you think ?

It is always difficult to predict how the market will behave but we can always make some analysis.

There are a few perspectives we should focus when analyzing the market.

First, let us walk through the recent high level market trend.

Average land prices in Japan rose from a year earlier for the first time in 27 years in 2018, fueled by the increasing foreign tourists and by urban areas where redevelopment projects are ongoing.

For example, the number of foreigners who stayed overnight in Kyoto in 2017 totaled 3.53 million, a record high.

The national average of benchmark land prices as of July 1 (in 2018) rose 0.1 percent from a year earlier.

The national average of commercial land prices was stronger than the residential segments and it went up

by 1.1 percent.

Apart from the three major urban areas in Tokyo, Osaka and Nagoya commercial land prices also rose in the four major local cities of Sapporo, Sendai, Hiroshima and Fukuoka by 9.2 percent on average.

The sharp growth in these local cities was also attributable to the increase in foreign tourists.

Investments in real estate were also pouring into large local cities due to the extremely low interest rates.

Money is very cheap now in Japan and it is always seeking some destinations.

The highest commercial land price in Japan was a small lot in the Ginza of Tokyo.

The price was 41.9 million yen per m2 exceeding the record of 38 million yen in 1990 (during the Bubble economy).

On the other hand, land prices in other local areas are still falling and

a number of rural municipal have been seen the down turn of the land price for almost three decades.

‘Average price’ always plays a tricky game here and I can say the market is very patchy. Some urban locations are enjoying very steady growth

but there are a number of local areas which are not really relishing the current market movement.

Second, the foreign investment is weakening. According to a recent report by Nikkei, foreign buying, which made up more than 30% of all transactions a year earlier, tumbled 90% on the year to 91.9 billion yen. in the six months ended December.

Relatively low prices had made Japanese real estate an attractive asset compared with property on other markets, but that perception has changed.

The number covers only for the six months, it is too early to say if the trend will continue but it could the sign of the down-turn.

Third, let’s look at the recent developments in the market.

It is said that the leading indicator of the real estate market in Japan is the second-hand condominium price in central Tokyo.

New condominiums market could be distorted by the large developers as a result of large marketing spending.

The center of Tokyo (a kind of CBD) is constituted by 5 wards; Shinjuku, Shibuya, Chuo, Chiyoda and Minato and if you

include Meguro and Shinagawa it is called central 7 wards.

The unit price of second-hand condominiums in these center districts is an early indicator of the real estate market and very linked with the general sentiment of Nikkei Index.

The main target customers of the second-hand condominiums in center districts are high-income and high net-worth business

people and they also play with stocks. NIKKEI Index has been showing the defensive movement since last autumn so as the average price of condominiums of 5 center districts.

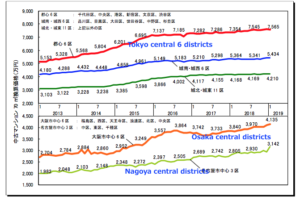

Next, we would like to check the recent statistics announced by Tokyo Kantei which specialize in the real estate information service.

Tokyo Kantei has just announced the price behavior of the pre-owned condominiums in major metropolitan cities during January 2019 in their monthly report.

The price used is for the condominiums 70 m² (standard condo size for family use)

In January 2019 , Tokyo region (greater Tokyo) went down by 0.5 percent compared with the previous month.

The Kinki(Osaka area) region also slightly fell Chubu (Nagoya) maintained a rising speed to exceed 10% in the same month of the previous year.

By prefectures, the price in Tokyo metropolitan area (central 23 wards and other regions)

remained almost unchanged at 49.42 million yen while maintaining the price level.

in Kanagawa prefecture it fell 1.0 percent at 29.30 million yen.

and Saitama prefecture (down 1.0 percent , 22.91 million yen) 3 It fell for the first time in a month. Also in Chiba Prefecture, which updated the most recent value in the previous month, the result was slightly weaker, at down 0. percent to 20.39 million yen.

The average of the Kinki area also turned out to be a slight drop, it fell 0.3 percent to 22.61 million yen, compared with the previous month,

Price movement between 2013 and 2018 : second hand condominiums Tokyo central districts

and other cities by Tokyo Kantei (Click to enlarge)

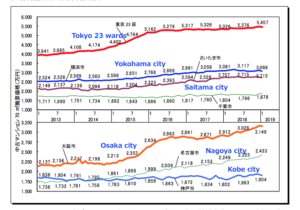

Price movement between 2013 and 2018 : second hand condominiums Tokyo(23 wards), Yokohama, Saitama, Osaka, Nagoya and Kobe

by Tokyo Kantei (Click to enlarge)

Osaka prefecture showed an upward trend through 2018, but this month

it was leveled at 24.67 million yen and the continuous rise stopped in 6 months.

Meanwhile, in Hyogo prefecture, was down by 0.7 percent, 19.31 million yen, lowered the price level for the first time in three months.

The average number in the Chubu area is +19.31 million yen, + 1.5% compared with the previous month, + 2.1percent in Aichi Prefecture,

20.98 million yen, showing a strong degree of rise while other urban areas are weak.

By city segments, the prices in Tokyo 23 metropolitan wards were slightly weaker at 54.57 million yen down 0.1percent compared to the previous month.

Meanwhile, in the City of Yokohama, it fell by 1.4 percent to 30.68 million yen for the first time in three months, in Saitama City it decreased slightly, fell to 27.15 million yen down 1.6 percent

The prices of major cities in the Kinki region, price in Osaka city turned down slightly to 31.49 million yen, down 0.6 percent.In Osaka city,

the upward trend ended which continued since the second half of 2018. In Kobe City, it fell to 19.04 million yen down 1.1 percent

In Nagoya city, the price rose by 2.6percent compared with the previous month to 24.33 million yen. Nagoya’s price trend is on an upward trend due to the rise in actual demand and investment needs.

Generally speaking, price affordability of standard second-hand condominiums are diminishing due to the rapid growth of the market and the fact that average income of Japanese households is flat,

Finally, let’s see the market from the global perspective.

Swiss bank group, UBS published the annual global real estate bubble index 2018 in October.

The report says about Tokyo

“The city’s housing market continues to decouple from the rest of the country’s.

Since 2015 prices in Tokyo are up 17%, while they are at nation wide.

The city’s demographic outlook is relatively supportive as its population is expected to go on growing.

Low interest rates are also sustaining the local boom,

but housing is becoming increasingly unaffordable as income growth lags behind.”

UBS Global Real Estate Bubble Index 2018 (Click to enlarge)

Final thoughts

In the global perspective, prices in Japan are not in the bubble however the affordability of the second hand condominiums

is diminishing.

The interest rate (financing cost) which affects the cap rate (a cap rate is often calculated as the ratio between the net operating income produced by an asset and the original capital cost)

is still historically low and there is no sign of rising.

I don’t think Tokyo market has been going up due to the 2020 Olympic.

Of course, we have seen the a lot of re-development projects in Tokyo in recent years

but Greater Tokyo has about 40 million population and it is always evolving.

iN MY OPINIO, all in all, the market should find some dips in coming 2-3 years but would not collapse

in any way. As you can see the charts above, the condominium market in Tokyo has been pretty flat for

last two years.

Other Helpful Articles

Expect home sales to continue on a downward trend ? : Japan real estate market recap 2018

Japan market update. How are big players betting ? : Is it in the state of bubble ?

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and Sell Real Estate in Japan”is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link