Competitive Landscape in Japan’s

Home Loan Industry

: Unraveling the Impact of

Internet-Only Banks

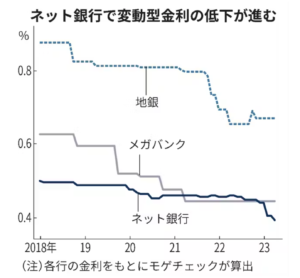

The Japanese home loan market is witnessing fierce competition, with internet-only banks

such as au Jibun Bank and SBI Sumishin Net Bank leading the charge.

These banks leverage their lower operating costs to offer attractive interest rates

on variable-rate home loans.

Recently, au Jibun Bank expanded its preferential rates, reaching as low as 0.196%

for some customers. Meanwhile, SBI Sumishin Net Bank,

which has a market share of around 5%, reduced its refinancing rate to 0.299%.

Traditional banks are also competing by lowering their expenses through digitization

and offering competitive interest rates.

Despite the Bank of Japan’s decision to raise the long-term interest rate target,

which has increased fixed-rate home loans, the competition

in the variable-rate market remains intense.

As a result,borrowers should carefully assess their options

and consider their financial situation before choosing a home loan.

Source:https://www.nikkei.com/article/DGXZQOUB14DD20U3A410C2000000/

(Insight)

The Japanese home loan market has recently experienced intensified competition,

particularly between AU Jibun Bank and SBI Sumishin Net Bank.

SBI Sumishin Net Bank,which went public at the end of March,

has gained a market share of about 5%

by offering a low-cost online application process.

This month, the bank lowered its refinancing application interest rate from 0.428% to 0.299%.

By utilizing artificial intelligence (AI) to keep loan review costs low,

these banks have been able to maintain competitive mortgage loan interest rates.

If they continue to offer low-interest rates, it could help sustain the strength of

the real estate market in the short term.

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and Sell Real Estate in Japan” is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link