(Tokorozawa station, Seibu line)

* Foreigners can buy a property in Japan without having special qualification.

Do you want to join the small handful of people who are doing the house flipping here ?

Maybe we have got a better solution to abandoned houses problem in Japan.

Apparently home flipping investment is a lucrative and fulfilling way to make thousands of dollars within a short period of time in US. But it can also be a difficult and frustrating endeavor when things go wrong.

And things will often go wrong. I have read about the stories that investors talk about the various obstacles in their way. Flipping homes requires hard work, persistence, and a great deal of patience,

because you’ll inevitably encounter problems in the process.

What about the flipping houses Japan ?

Since there are so many abandoned houses here in Japan, can we do something similar ?

The answer is yes and no.

Let me start with the background by quoting an article in The Japan Times.

Background

The Japan Times on December 26, 2017 says “Over 8 million properties across Japan are unoccupied, according to a 2013 government report. Nearly a fourth have been deserted indefinitely, neither for sale nor rent.

In Tokyo — where 70 percent of the people live in apartments — more than 1 in 10 homes are empty, a ratio higher than in cities like London, New York and Paris.

And that figure is expected to soar in the coming decades as deaths outpace births in a super-aging society where more than 1 in 4 people are 65 or older.

Nomura Research Institute, prominent research firm, projects the number of abandoned dwellings to grow to 21.7 million by 2033, or roughly one-third of all homes in Japan.

Meanwhile the population, which peaked nearly a decade ago, is forecast to fall 30 percent by 2065, creating an ever-increasing pool of uninhabited houses.”

So what is the solution to this abandoned house problem ? One of the solutions is “House Flipping in Japanese style”, provided you find a right property in a right location.

If you can flip these akiya (abandoned houses) into a rental property, you may be able to make it lucrative.

But really ?

Apparently the reality of the business is much tougher than it appears on reality television in US.

The popularity of buying properties to renovate and sell at a profit is steadily increasing, and many people in the industry credit this to reality shows about the practice on networks like HGTV, according to the New York Times.

In the New York area, flips made up 5.6 percent of sales in 2017, a 29 percent increase from 2016, and throughout the country, Americans flipped 207,000 condos or single-family homes,

the highest number in 11 years.

But when people actually start doing it themselves, they can find it extremely difficult to make a sizable profit and get the house ready to sell.

Obviously I am not a pundit of US real estate business but these are the main reasons why the reality is much tougher than it appears on reality TV in US.

Delays

Service providers may get delayed on prior jobs, especially when they’re doing roofing or other exterior work.

Government Regulations

For example, the Federal Housing Administration (FHA) has a rule that you must own a home for at least 90 days before you can go into contract with a buyer who’s using an FHA loan.

Unforeseen expenses

When you’re remodeling a home, chances are that you’ll have unplanned, not budgeted expenses.

That’s just the nature of the investment.

You also want to prevent these issues or deal with them more easily in Japan as well.

Here is how it works in Japan

Usually house flipping in the US is referred as a short-term strategy i.e. buying and renovating a house and sell it at higher value in the short term. A flipper usually needs to get out in less than six months.However,

in Japan, it is not a very common practice.

In Japan, we buy a house (usually an abandoned house) and renovate it into a rental property.

Unlike in US, house flipping investment is a rather unusual investment and not touted in the market yet.

It may not not as lucrative as US’s flipping and a long-term investment seeking the income gain rather than the capital gain. (we could expect the capital gain but chance is slim)

Thus you want to be more careful when you buy a property.

You don’t need to stick to akiya for flipping but they are naturally very affordable to come by.

I recently went to the field survey with our business partners to find a good property in Saitama prefecfure which is north of Tokyo.

He is actively investing in akiya (abandoned house) for about 5 years.

We usually locate a property in suburban areas of Tokyo where you can find a decent one for flipping.

Here is the property we saw in Tokorozawa in Saitama prefecture

(Tokorozawa station)

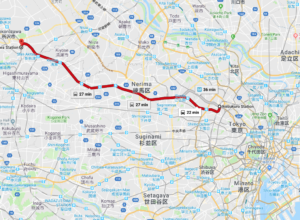

Tokorozawa city is about 30km away from Ikebukuro, Tokyo and it takes only 30 mins by train to

Ikebukuro station (Ikebukuro stn is one of the busiest terminal stations in Tokyo)

The population of Tokorozawa city is 344,000 and it is not shrinking (not yet anyway! )

(Map)

Profile of the property

Built 1969 (49 years old)

Land 42 m2

Building 47ms

10 mins walk to the nearest station.

(Outside of an abandoned house in Saitama)

(Inside of the house)

(Inside the house)

Looks pretty bad, huh ?

In fact, this was one of the worst condition I have ever seen. But if you renovate it with the expertise of professional builder’s skill about flipping, I am sure this house will offer the adequate quality of the rental property.

Meanwhile, right next to this abandoned house, there are nice modern houses as below.

(Neighbours)

(Neighbours)

(Neighbours)

Finding respectful neighbors is a good sign.You don’t want to buy a property where the population is shrinking faster than the average pace.

(The view from the abandoned house)

As you can see, the location is good and there are charming houses around.

In fact, the area is next to one of the posh neighborhoods in Tokorozawa.

This is another good sign to find your tenant.

So how does the math works ?

Here is the crude projection of the investment

Total initial investment

including the property and renovation cost : 5,300,000 yen (U$53,000)

Gross Yield (basis 100% occupancy) : 10.87 % on Initial investment

Rent : 48,000 yen per month

It is very difficult to get financing from a bank as the abandoned house worths next nothing in bank’s mortgage valuation system.

Bottom Line

The most important point with a flipping project in Japan is locating a suitable property in a right location.

And letting the process aggravate you depends on you being flexible and working with a reliable agent and a builder.

Obviously being a damaged abandoned house, you need to do the necessary cosmetics but you must keep the budget in control.

If you work with a builder who is not familiar with the flipping business, your renovation cost could be ballooning and no way to make money from the investment.

There’s no way that a real estate project will ever go according to plan from beginning to end but you need to manage somehow.

p.s.

These are the recent photos of other flipped house (not the same property in Tokorozawa)

As you can see, when you are doing house flipping in Japan, you don’t need to make it pristine condition but keep it nice and clean meeting the standard QOL.

If you are interested in the house flipping, please contact us.

We will provide more information and other listings.

Other Helpful Articles About Akiya house Flipping

You want to flip akiya (abandoned house, 空き家) into a rental property in Japan ? : Please do the math first

Tokorozawa city official web site

Our Consultation service

Spot consultation is available for those who are interested in buying an old Japanese property.

Spot consultation fee starts from 50,000 yen per two hours (plus tax). Consultation over Internet telephone is possible for those who are distant from Tokyo.

If you are seriously interested in buying akiya, please contact us. Consultation fee starts from 50,000 yen per two hours (plus tax). We provide the following consulting service for akiya investment as well.

1) Akiya search service

100,000 yen (plus tax) per project. We will look for an appropriate akiya for you.

It requires time consuming process.

Finding a good akiya is not as easy as you might think.

If you buy a wrong property in a wrong location, your investment could be a disaster.

We will not search akiya for free.

If you are seriously interested in buying a Japanese old house, please contact us.

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and Sell Real Estate in Japan”is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link

(

(