Where is the most expensive location in Tokyo ?

Ginza in Chuo-ku.

You are right. In terms of face value, Ginza is the most expensive location in Japan and those expensive

locations are commercial areas.

What about the condos relative to the ratio of rent ?

With the rise in land prices, real estate has become difficult to buy year after year.

Where is the area which is relatively cheaper than other areas in terms of the payback period using

the rent you have to pay ?

Real estate research firm Tokyo Kantei announces “Condominium PER” every year for new condos

as one of the judgment criteria.

Recently, the latest version of 2018 was released.

Condominium PER is a value that determines how many years the newly built condominium corresponds

to the rent of the condominium in the same station area, and is calculated by “Condo price ÷ yearly rent “

Main target for PER is 70m2 family type condos.

The lower the PER figure is, the cheaper the rent will be, and the easier it is to buy, and the higher the PER figure, the harder it will be to buy.

Note that Tokyo kantei only pick up condominiums which are less than 3 years old and is calculated for properties within 20 minutes on foot from the nearest station.

Let’s look at the Tokyo Metropolitan area (東京都)

The lowest price for apartment PER, meaning the most inexpensive station, was 15.23 at Keio Tama Center.

The monthly rent converted to 70m2 is 193,368 yen. “Musashi Urawa” (15.62) and “Misato Chuo” (16.16) followed, and these three stations became the best 3 in the bargain.

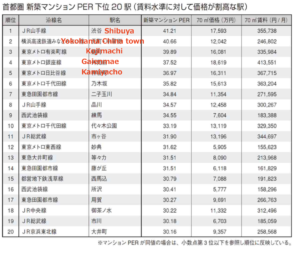

Please see the ranking of expensive stations (relatively more expensive)

(Relatively more expensive locations (stations))

The average PER in the metropolitan area is 24.96 covering 202 stations .

Although the average rent in total metropolitan area was ¥ 241,631 per month (up 7.4% from the previous year), the average price of new condos was ¥ 73.44 million, which was a significant increase of 9.9% compared to the previous year, and the recouping period of purchasing funds has increased by about 0.5 years.

Over all, in Tokyo area, PER has become harder to buy (meaning a sense of overpriced).

The most expensive spot in the survey was 41.21 in Shibuya.

The monthly rent in Shibuya is 355,738 yen.

In addition to the popular area of Jonan (south from Imperial palace) and Josai(west from imperial palace)

in the area inside the JR Yamanote Line and as a residential area, the aftermath of soaring prices also extends to the Joto (east from imperial palace) area, which has maintained a sense of affordability.

In Tokyo Bay area, Kachidoki, Tsukishima and Toyosu, PER is generally higher than the metropolitan area average.

The price at the top of the Keio Tama Center, which has a bargain price, has become a reasonable price range with newly built apartment prices at 51.26 million yen in 2016, 41.65 million yen in 2017, and 36.04 million yen in 2018.

(Relatively more affordable locations (stations))

However, in Tokyo Kantei reports, “The Keio Tama Center has improved its PER due to the supply of relatively inexpensive large-scale apartments where you have to take bus service from the station and a 15-minute walk from the station since 2017, but the station power (attractiveness of the station as a location) has not improved.

On the other hand, Musashi-Urawa Station which stands at No. 2 has a sense of bargain as it is seeking new development within a 10-minute walk, with the location environment improving, regional power and station power are increasing.

In addition to the decline in apartment prices, the monthly rent for the Keio Tama Center is in the 190,000 yen per month range, which is significantly higher than the conventional 140,000 yen in the area.

However, high rent cases are also generated from large-scale condominiums at Station located a bit far from the station.

It is clearly outweighed by the market price considering the time taken from the nearest station although it is new construction.

There are other areas where PER appears to improve due to such specific property biases.

For example, Meguro Station (PER 20.14) with a sense of bargain 19 is strongly affected by the station square tower property developed by a major real estate property, and the monthly rent for that property is about 320,000 yen per month.

As areas that can not see PER on a par with the bias of specific properties, that is, stations that appear to be cheap in appearance, it is assumed that Tabata and Hanakoganei in Tokyo, Yokohama in Tokyo suburbs, Kashiwa Campus and Yachiyo Midorigaoka in Chiba Prefecture, etc. .

On the other hand, Shibuya, which has the highest PER, you need to spend 16 years more to repay the price than the average length in the Tokyo Metropolitan area.

The monthly rent in Shibuya is ¥ 355,738, which is more than ¥ 100,000 higher than the Tokyo metropolitan area average, but the new condos price is as high as 170 million yen, which makes PER higher.

In addition, stations in the Tokyo area with rents of 300,000 yen or more are Aoyama 1-chome (638,543 yen), Roppongi (536,258 yen), “Omotesando” (444,752 yen), “Yotsuya” (360,953 yen) There are “Kamiyacho” (367,715 yen), “Ichigaya” (340,697 yen), “Kojimachi” (335,984 yen), “Shinagawa” (300,267 yen) and so on.

“Aoyama 1-chome” (PER 22.71) is the lowest figure compared to the previous year’s RER.

A year ago it was a feeling of top price, but it has dropped by 22.55 points.

The recoup period in terms of rent (385,302 yen) has been shortened significantly.

In Aoyama area, the small-to-medium- and low-rise apartments were sold in 2018, and the new construction price was reduced by about 35 million yen, but a large number of expensive rent cases were generated from the tower apartment near the station.

The station that became the most gain of PER from the previous year was Tokorozawa (PER 30.41).

The payback period in terms of rent (158,296 yen) requires 30 years or more.

While the monthly rent is almost flat, the new condos price has risen 32.0% YoY.

Until now, most of the high-priced condominiums were supplied along JR Chuo Line and Tokyu Denentoshi Line. Recently, starting with the redevelopment of the station area, Tokyo suburbs and suburb areas in the surrounding three prefectures.

The supply of high-spec, high-priced new condominiums is intensifying.

It is reflected in the rising ranking of a sense of relative higher price.

In the same survey, it became clear that there are fewer bargain areas as a whole, but even in expensive areas, the demand in central Tokyo, such as Shinagawa, is strong, especially for investors.

It is said that areas such as central 3 wards and 5 wards are still popular.

Tokyo Kantei report (in Japanese)

In the meantime, if you look at the bubble index which is announced by UBS every year.

In Hong Kong, even those who earn twice the city’s average income would struggle to afford an apartment of that size. House prices have also decoupled from local incomes in London, Paris, Singapore, New York and Tokyo, where price-to-income multiples exceed 10.

Unaffordable housing is often a sign of strong investment demand from abroad, tight zoning and rental market regulations. If investment demand weakens, the risk of a price correction will increase and the long-term appreciation prospects will shrink.

UBS bubble index is based on the calculation, buying a 60m2 (650 sqft) apartment exceeds the budget of people who earn the average annual income in the highly skilled service sector in most world cities.

Remarks:

The general tendency of the territorial property price in central Tokyo is often valued

by the distance from the imperial palace and the direction from the imperial palace.

The closer to the imperial palace, the more expensive the property is.

Historically Josai (west from the imperial palace) and Jonan (south) are more upscale area.

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and Sell Real Estate in Japan”is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link