Overall, Japan looks to be shrinking but big cities are expanding.

How does it have an implication on the real estate in Japan.

I have been hearing a question repeatedly from a number of my

foreign friends (and Japanese friends, too), that is “Why do you

want to invest in the property in a country where the

population is decreasing ?”

It is very true that overall Japan is shrinking but when it comes to the real

estate investment such naive macro view could mislead your decision.

The population growth is one of the biggest factors in the property

investment in deed and a growing population should give you the opportunity

to raise rents over time and also should enhance values of your property.

However you need to see the numbers in depth.

The Japanese Government recently announced the official intra

population movement report(statistics of intra-prefecture migration)

in 2017.

Based on the investors view, here are your takeaways from the announcement.

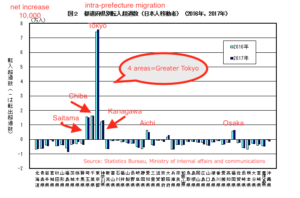

1. Tokyo area (greater Tokyo) won’t stop growing

According to the report, the greater Tokyo area (Tokyo, Saitama, Chiba, Kanagawa)

was in “net surplus” in which the number of the net inflows stands at 117,779.

Net surplus (net increase of the population) in the greater Tokyo area has posted

for 22 consecutive years, net surplus number (growth) has also

increased since 2009.

Looking at the each number of domestic migration by prefecture in 2017,

only seven prefectures of Tokyo, Chiba, Saitama, Kanagawa, Fukuoka, Aichi

and Osaka are in net surplus. The largest number of net inflow is shown in Tokyo

as prefecture (net 75,598 surplus), followed by 16,303 in Chiba and 10,423 in Saitama.

You can find the stark contrast among the prefectures in the following chart

which was published by Statistics Bureau of ministry of the internal affairs

and communications on January 29, 2018. If you are the savvy investor, message of the chart is signaling is a no brainer.

There are plenty of good opportunities in greater Tokyo and

thus you have to start looking at properties in

greater Tokyo area first.

(You can enlarge the image by clicking)

2. 40 prefectures out of 47 are shrinking

Total of 40 prefectures including Fukushima, Hyogo, Hokkaido, Niigata

and so on see the net outflow of the population.

3. Three major industrial areas are surviving but both Osaka and Nagoya are struggling

Among the major three metropolitan areas (Tokyo, Nagoya, Osaka), only the number of

inflow in the Tokyo increased by 1911 in 2017.The Nagoya area (Aichi, Gifu, Mie) decreased 4979 people and

the Osaka area (Osaka, Hyogo, Kyoto, Nara) decreased 8825 people,

both for the fifth consecutive year.

4. 3 quarters of cities and towns in Japan are shrinking

Over all, 76.3% of all cities, towns and villages are in deficit (net outflow)

and thus the concentration in greater Tokyo area is accelerating.

At municipality level, among the 1719 municipalities nationwide in 2017,

net increase was seen in 23 wards of

Tokyo (60,118 people), Osaka City (10 691 people),Sapporo City (8779 people)

and so on.

Only 408 Municipalities saw the net increase.There are 1311 municipalities

including Kitakyushu City (2248 people), Sakai City (2211 people),

Nagasaki City (1888 people) and so on that saw the net decrease.

In other words, if you are carefully selecting the areas,

you also should be able to find good opportunities in

the local cities but be cautious.

The Abe administration, which states “revival of local regions”, is likely

to be forced to undertake a drastic review of measures.

Toshihiko Yamamoto

Real estate investing consultant and author.

Toshihiko is currently writing a book about the real estate investing in Japan

for foreign investors.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and a MBA from Bond University in Australia.