Rising Used Condominium Prices in Tokyo and Major Japanese Metropolitan Areas

Tokyo Kantei Press Released on March 23, 2023

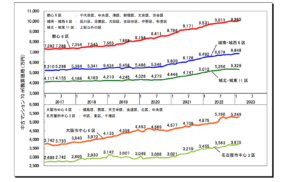

Major Cities in the Three Major Metropolitan Areas: Monthly Trends in Used Condominium Prices (70 sqm)

In February, used condominium prices in the Tokyo metropolitan area increased

by 0.4% compared to the previous month, reaching 48.66 million yen,

marking the third consecutive month of increase.

In central Tokyo, prices once again surpassed the 100 million yen mark.

The average prices in the Kinki and Chubu regions also continued to rise modestly,

with no significant downward movement seen in the market.

In February 2023, used condominium prices in the Tokyo metropolitan area

rose for the third consecutive month, with a slight increase of 0.4% compared to the previous month,

reaching 48.66 million yen.

When looking at the data by prefecture, Tokyo saw an increase of 0.7% to 64.41 million yen,

surpassing the record high set in December of the previous year.

In Kanagawa Prefecture (+0.4%, 36.68 million yen), prices continued to rise compared

to the previous month, while in Chiba Prefecture (+1.7%, 28.29 million yen),

prices have been on an upward trend since April of the previous year.

On the other hand, prices in Saitama Prefecture decreased slightly by 0.4% to 30.49 million yen,

marking the first decline in six months.

The average price in the Kinki region increased for the first time in two months,

with a slight increase of 0.2% to 29.14 million yen, due to the strength of the Osaka area.

In Osaka Prefecture, the price showed a similar movement with a 0.2% increase to 31.28 million yen,

but it did not surpass the level reached in December of the previous year.

On the other hand, in Hyogo Prefecture, where there has been a slight increase in older properties,

the price dropped by 0.8% to 25.52 million yen, marking the first decline in four months.

The average price in the Chubu region increased by 0.3% to 23.1 million yen,

while in Aichi Prefecture, it increased slightly by 0.2% to 24.35 million yen.

Although the growth remained modest, the year-on-year increase rate still maintained in the 6% range.

*

Central six wards Tokyo (most central) in red.

Used 70m2 condominiums

in 10000 yen

130 yen=US$ as of April 14, 2023

*

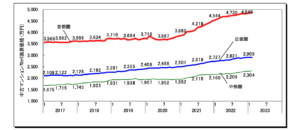

Greater Tokyo (red)

Kansai area (blue)

Chubu (Nagoya) area (green)

Used 70m2 condominiums

in 10000 yen

130 yen=US$ as of April 14, 2023

source:https://www.kantei.ne.jp/report/c202302.pdf

(Insight)

It seems the market is hitting its peak in the short term.

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and Sell Real Estate in Japan” is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link