If you are seriously interested in the real estate investment in Japan, the hotel segment is growth potential.

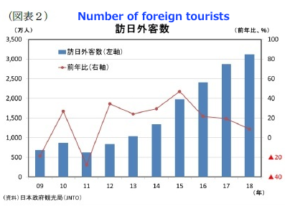

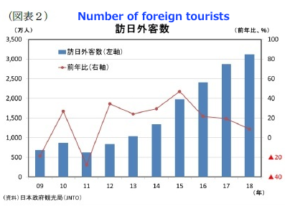

The number of foreign tourists to Japan is set to rise for the seventh straight year and hit a record level of

more than 30 million in 2018.

(Chart : Number of foreign tourists, unit: 10 thousand)

The government is targeting 40 million foreign visitors by 2020, when Tokyo will host the Olympics.

Japan accepted an all-time high of 28.69 million foreign visitors in 2017, up 19.3 percent from the previous year

and the number of visitors are still on rise.

The estimated number of foreign visitors to Japan in February 2019 rose 3.8 percent from a year earlier to a record 2,604,300,

but the growth in Chinese tourists slowed.

By country and region, the highest number of visitors came from China at 723,600, up 1.0 percent from a year earlier,

according to the Japan Tourism Agency.

However, the pace of growth slowed from 19.3 percent in January with a declining number of cruise ships making stops in Japan.

South Korea was second at 715,800, up 1.1 percent, followed by Taiwan at 399,800, down 0.3 percent, and Hong Kong at 179,300, up 0.5 percent.

The number of visitors from Southeast Asia jumped in February, with Vietnam marking a 68.6 percent leap to 39,400,

Thailand up 31.4 percent to 107,800, and the Philippines up 28.0 percent to 35,200, according to the agency.

On a yearly basis, the number of foreign tourists visiting Japan surpassed 30 million in 2018.

Read more