Tokyo kankei (Japan’s institute for real estate study) recently announced

the market report on the condominiums in greater Tokyo area.

We have made the recapitulation of the report for the clients.

I will share a part of our report today.

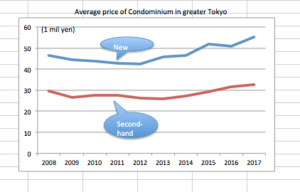

Both prices of newly built second-hand condominiums and

unit price per square meter has gone up.

New construction projects were supplied mainly in central area of Tokyo

which sharply makes price rise.

The average price in the Tokyo metropolitan area (Tokyo and neighbouring cities) of newly built condominiums was 55.44 million yen, up + 9.0% from the previous year’s 50.87 million yen.

Because it was falling the previous year, it rose for the first time in two years, and the

whole metropolitan area shows a trend of rising again from a high stop.

The reason for price rise was due to the strong tendency of supply to concentrate in central Tokyo.

The average area for each condominium was 63.24 square meters, which was up 3.1% from 61.33 square meters in the previous year.

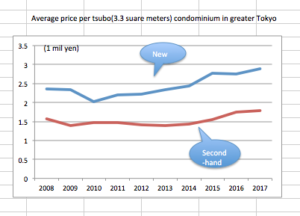

The average square measures of the Tokyo metropolitan area had been decreasing for 3 consecutive years until 2016, but it began to expand for the first time in 4 years.The average tsubo (3.3 square meter) unit price was 2.898 million yen, rising + 5.7% from 2.742 million yen in 2016 due to concentrated supply to central Tokyo.

Meanwhile, the average price of second-hand condominiums in the metropolitan area was 32.57 million yen, up + 3.2% from 31.55 million yen in the previous year.

Price of second-hand condominium has been rising for the fourth consecutive year. Second-hand price increased in 2017 lead by newly built condominiums upward trend. area

As a result, there are differences in rate of price rise depending on the area, such as the trend of second-hand circulation prices to be capped at the central Tokyo area where new prices have ceased and the price has ceased. The average occupied area was 60.11 square meters up 0.3% from 59.96 square meters of the previous year.

The market saw the rise of the pice first time in three years.

The average area in the Tokyo metropolitan remained at a level slightly above 60 square meters in the past 10 years but the level of the occupied square measures does not change significantly.

The average tsubo(3.3 square meters) unit price was 1.791 million yen in 2017, 2.9% higher than the previous year’s 1.740 million yen.

Although the tsubo unit price rose greatly for 3 consecutive years since 2014, it is a relatively mild rise in 2017

*The following information is mainly useful for property for the investment

rather than own use. (buy to let property)

Number of newly built apartments, studio type properties less than 30 square meters rapidly has increased since 2014 and went up 19.7% in the previous year, but in 2017 it decreased by 18.0%, the first downward movement since 2013.

The average area measures expanded for the first time in four years,

In the second-hand condominiums, the average area footage was only 0.3% year-on-year expansion, so the distribution of the market of square footage is almost unchanged.

Although the second-hand condominium price has increased and apartments with a large area become more expensive, the market

of small condominiums is declining.

Finally we analyzed the market from the view-point of the distance from the nearest station.

Ideally within 10 mins walk from the neatest station.

Until 2014, the share of the properties within 3 minutes walk had been shrinking year by year due to land acquisition difficulty, but in 2017 it showed an expansion trend again and went up by 19.8%.

The share of properties within 4 to 7 minutes walk remained almost unchanged from the previous year at 40.4%, maintaining the largest share.The total share those within 7 minutes walk shifted from 58.8% to 60.2% since 2016.

And this shows that even in the situation of land acquisition difficulty, the new supply at the station within 7 minutes is increasing.

*Please note majority of people in cities including Tokyo want to live within 10 min walk from the station.

Conclusions

I am also attaching the historical charts showing average price of 3.3 square meter of condominiums in Tokyo between 2008 and 2017

*3.3 square meter is the traditional unit for real estate trade in Japan.

Blue line indicates new condominiums and red is second-hand.

In 2017 newly built condominiums and second-hand condominium went up

by 5.7% and 2.9% respectively.

Considering the prolonged deflation in Japan’ s economy, the price of condominiums have been very firm

however, the growth rate is moderate.

Price growth has outpaced average earnings growth, which is further ratcheting up the affordability challenge

but it is not out of reach like Hong Kong or London.

In the global context, according to an article in Financial Times on February 22, 2018,in Hong Kong

prime homes have increased 160 %.

“Average sales prices for Hong Kong homes are now HK$24,900 ($3,182) per sq foot, more than a quarter higher than those in prime central London ($2,510 — roughly £1,800) and nearly double the cost in regional neighbour Singapore ($1,757).”

Price in Hong Kong just unaffordable.

FT Hong Kong property market

In addition, strong intention to buy among consumer is still in the market place.

One report by an institute in Tokyo says that about 60% of the respondents intend to buy a residential property in the next 2 years.

The purchase intent for condominiums has been stable and not hampered by the price hike.

Optimism in the residential market may have convinced some buyers to take the plunge before prices rise further.

1.Below chart showing average price in greater Tokyo (Tokyo and neighboring cities) for 10 years.

2. Below chart showing the average price per 3.3 square meters for 10 years

*Price of new condominiums per square meter: U$7961, second-hand U$4931 in 2017

If you wan to calculate approx. price per square foot, please divide square meter by 10.

(Please click to enlarge the images)

Cities most at risk of a real estate bubble are (according to UBS):-

1 Toronto

2 Stockholm

3 Munich

4 Vancouver

5 Sydney

6 London

7 Hong Kong

8 Amsterdam

9 Paris

10 San Francisco

Tokyo is at high side but not in the bubble.

Toshihiko Yamamoto

Real estate investing consultant and author.

Toshihiko is currently writing a book about the real estate investing in Japan

for foreign investors.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and a MBA from Bond University in Australia