Truth to be told.

1 in 7 homes across the country is empty.

Around 5 million of Japan’s vacant homes are intended for future sale or rental.

The phenomenon is a function of a declining population and the continued pace of housing construction.

Despite being the world’s third-largest economy, Japan’s population has been shrinking since 2010.

The population is also getting older.

A new survey shows the problem is far greater than expected.

The government recently announced the new survey result about akiya (unused house)

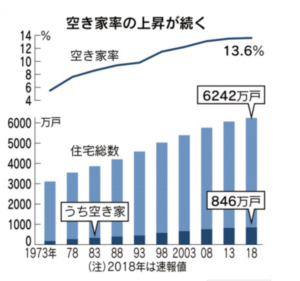

According to the Housing and Land Statistics Survey in October 2018 announced by the Ministry of Land, Infrastructure, Transport and Tourism, the ratio of akiya (unused house) to the total number of dwellings in the country was a record high of 13.6%

,meaning 1 in 7 homes across the country is empty.

The number of unused houses increased due to population decline mainly in the rural areas, and the number of unused homes

reached 8.46 million.

8.46 million houses are not used !

In Tokyo and Osaka, the rate of vacant houses exceeds 10%, and there are also areas that are overshadowed.

The government publish preliminary figures of housing, land statistics investigation to carry out once every five years.

The number of unused houses increased by 260,000 from 2013, and the ratio to the whole rose by 0.1 point.

The total number of homes has a record high of 62.24 million.

Although the growth rate of all segments has fallen (such as the total number of homes, the number of unused houses)

and the upward trend of the unused houses continues.

Of the unused houses, 3.47 million were homes that were vacant or were to be demolished for a long time.

There were 4.31 million unused homes/rooms to let (for rental use), 290,000 for sale, and 380,000 “secondary homes” such as villas.

So the number of REAL akiya was only 3.47 million.

By prefecture, the highest rate of unused houses is Yamanashi’s 21.3%.

It was followed by 20.3% Wakayama, 19.5% Nagano and 19.4% Tokushima.

In rural areas, the population decline is more significant and that contributes the current situation.

Saitama and Okinawa stand at 10.2%

Tokyo 10.6% and Kanagawa 10.7%

If there are many vacant houses in the location, security concerns will increase.

Without knowing the owner, the house can not be removed,

which may become a rebuff for the redevelopment plan of the area.

Honjo City, Saitama Prefecture has started a project to rent land where the owner dismantled a vacant house without charge, and to make it a park. The owner is exempted from property tax payment for 5 years.

If you sell the house or site you got by inheriting, there is a mechanism that you can subtract up to 30 million yen in transferred income that costs tax.

The deadline for the end of 19 years was extended by 4 years.

The central government is promoting financial support for municipalities working on removal and utilization of vacant houses and

bringing specialists.

Kachitasu, a major second-hand home reseller, buys an old house from an individual, renovate it, and sells it at a price of 10 to 15 million yen.

(Chart from Nikkei)

Other Helpful Article

*We don’t provide free consulting for akiya purchase.

Can you get a loan for akiya investment ?

Tranquil and Subtle : Fully renovated Machiya house in central Kyoto (YouTube video)

Final Thought

To be frank, the number of akiya did not increase as I expected. Japan’s developers are insanely keep constructing about 1 million of

new houses and flats across the country and I don’t see any major progress to change the law to accelerate the demolishing akiya.

The report was preliminary and I suspect that the government will revise the number very soon.

One of the very effective solutions is to control the total number of the total number of houses by the government.

Despite the fact of 8 million unused houses, the industry is keeping constructing about 1 million new houses/flats every year.

That is wrong.

I am not a big fan of the government’s intervention in the free economy but for this issue, maybe we should support the regulation by the government.

Please note there are a number of akiya across the country but none of them are free and akiya banks are not offering the free houses.

No municipal governments are providing the free houses as the many western medias (such as Bloomberg and Daily Mail etc) are reporting.

They are all wrong.

Akiya is very cheap but usually very run-down. You need to allow minimum 25 million yen for the renovation cost.

Our Consultation Service

Spot consultation is available for those who are interested in buying an old Japanese property.

Spot consultation fee starts from 50,000 yen per two hours (plus tax). Consultation over Internet telephone is possible for those who are distant from Tokyo.

If you are seriously interested in buying akiya, please contact us. Consultation fee starts from 50,000 yen per two hours (plus tax). We provide the following consulting service for akiya investment as well.

1) Akiya search service

100,000 yen (plus tax) per project. We will look for an appropriate akiya for you.

It requires time consuming process.

Finding a good akiya is not as easy as you might think.

If you buy a wrong property in a wrong location, your investment could be a disaster.

We will not search akiya for free.

If you are seriously interested in buying a Japanese old house, please contact us.

*

Akiya is very cheap but usually very old and run-down. You need to allow the significant cost for the renovation and cost could be as much as

25 million yen.

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and Sell Real Estate in Japan”is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link