Are you bullish or bearish ?

Two surveys by the major institutions revealed that both institutional investors and individual investors are bullish about the real estate market in Japan.

In the survey released by the Japanese real estate research institute in May, real estate price has been rising steadily due to the recovery of corporate performance and the expectations for the Tokyo Olympic Games and Abenomics.

The survey was conducted mainly for institutional investors.

However, 72 % of respondents say the real estate investment market is seeing the peak for the time being.

83.2% of respondents say many deals with remarkably low yields are appearing, compared to 68% in the previous survey in October 2017.

As for the view on investment in the next coming year, 90% of respondents say they will actively continue to make investments, up one point from the previous survey.

It indicates that the general consensus is still bullish.

Only 8% of respondents say they will be stopping the making new investment. Regarding the real estate market, attention is paid to interest rate trends in the United States and the monetary policy of the Bank of Japan.

As a whole investors’ willingness to invest is very positive

Regarding market expectation, the majority of institutional investors say that the market will expand in the next 6 months in both Tokyo and Osaka.

Meanwhile, in Nomura Real Estate Urbannet announced recentlythe result of the survey on real estate investment conducted for Nomcom’s individual investors. (the link below).

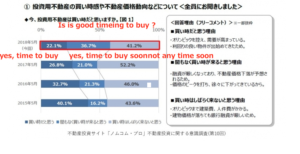

22.1% of respondents say it is the good timing to buy the real estate and 36.7% of respondents say time to buy will come soon, which makes about 60% people think it is good time to buy.

Regarding the reasons to buy the real estate, there are many voices such as “Tokyo Olympic”, “Tougher loan approval will lower the real estate price” and “price peaked”.

In the meantime, 32.6% of Nomcom investors answered that they exited the investment within the past three years.Of which, 44.7% say they have sold within past one year.As reasons for the exit, 57.9% of investors say that the real estate price rose and 57.0% of respondents say that it is for the rebalancing (buy and sell) of the investment. 50.6% of investors who own the real estate for investment also answered that they are considering buying more, and 32% of respondents answered considering the rebalancing (buy and sell). If you include the rebalancing, more than 80% of investors are considering purchasing more properties.

(Nomura survey)

As for the investment area in the future, the Tokyo district except Tokyo’s central 5 wards (Chiyoda, Chuo, Harbor, Shibuya, Shinjuku) was the most popular, with 62.6%, followed by the 5 central wards (54.4%). Looking at the property type, “apartment building” (52.6%) was the most popular, followed by “condo building” (48.8%) and “studios” (26.0 %).The forecast for real estate prices in the next year is “go down” (32.8%), up 6.2 points from the same period one year ago. “Same” (48.8%) accounted for nearly half, “go up” only 18.4%.

Regarding the reasons people responds as follows“There is no foreseeable reason for central Tokyo to go down”“The Tokyo Olympic Games” In the meantime, a number of respondents point out that getting bank loans are becoming tougher

and blaming it as a reason for price falls.More than half of respondents say that they feel the change of the sentiment of the loan application process (52.8%). Of which, 87.7% of respondents answered that the approval became tougher and the proportion of equity (downpayment) required increased (51.3%).In addition, as the most likely chance of affecting the Japanese real estate market in the negative scenario in the future world economy, “the US real economic downturn” (34.6%), “excessive interest rate rise by the US FRB “(28.3%), which is the result of high attention on US economic and monetary policy.

Other helpful posts

Where is the most attractive city to invest in Asia ? : CBRE institutional investors reports 2018

Nomura real estate urban net report

Final thought

Both institutional and individual investors are bullish about the market.

It is very important to note that the banks loan approval for individual investors are becoming much tougher compared to the situation a few months ago. The number of banks that is willing to finance foreign investors is decreasing. The banks who are currently offering foreign investors loan have toughened the loan-to-value limit.

My feeling tells me that the screening process for the loan approval is the most stringent in a decade and there is no sign of easing.If you want to enter into the market, I recommend to do it sooner than later.

Sharp price rise in recent 5 years in Tokyo’s 5 central wards put off investors buying more properties.

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and Sell Real Estate in Japan”is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link